Asked by carolette mckenzie on May 27, 2024

Verified

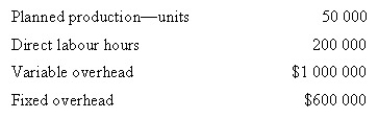

Hamilton Pty Ltd uses a standard costing system for product costing. The company uses direct labour hours as the cost driver to apply overhead costs. The following amounts were budgeted for the year:

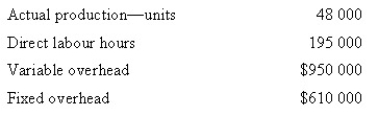

The following were the actual results:

Calculate the amount of variable overhead efficiency variance.

A) $25 000 favourable

B) $25 000 unfavourable

C) $15 000 favourable

D) $15 000 unfavourable

Standard Costing System

A cost accounting method that assigns expected costs to products in order to estimate the cost of production and help with budget planning.

Direct Labour Hours

The total hours worked directly on a specific job or task by employees, often used to allocate labor costs to products or services.

- Comprehend the elements contributing to discrepancies in standard costing, such as variations in variable overhead efficiency and fixed overhead volume variances.

Verified Answer

KS

Kaylie SorensenJun 02, 2024

Final Answer :

D

Explanation :

Variable overhead efficiency variance = (actual activity – standard activity) x standard rate

Actual activity = 20,000 hours

Standard activity = 22,000 hours

Standard rate per hour = $5

Variable overhead efficiency variance = (20,000 – 22,000) x $5 = $-10,000 or $10,000 unfavourable

Therefore, the answer is D) $15,000 unfavourable is incorrect, and B) $25,000 unfavourable is correct.

Actual activity = 20,000 hours

Standard activity = 22,000 hours

Standard rate per hour = $5

Variable overhead efficiency variance = (20,000 – 22,000) x $5 = $-10,000 or $10,000 unfavourable

Therefore, the answer is D) $15,000 unfavourable is incorrect, and B) $25,000 unfavourable is correct.

Learning Objectives

- Comprehend the elements contributing to discrepancies in standard costing, such as variations in variable overhead efficiency and fixed overhead volume variances.