Asked by Destiny Marsh on Jun 29, 2024

Verified

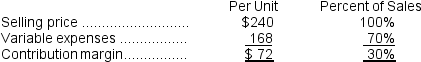

Hamiel Corporation produces and sells a single product.Data concerning that product appear below:  Fixed expenses are $301,000 per month.The company is currently selling 5,000 units per month.

Fixed expenses are $301,000 per month.The company is currently selling 5,000 units per month.

Required:

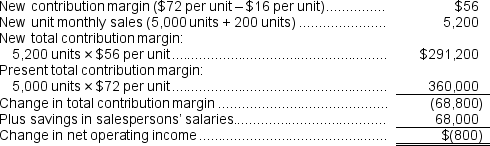

The marketing manager would like to introduce sales commissions as an incentive for the sales staff.The marketing manager has proposed a commission of $16 per unit.In exchange, the sales staff would accept an overall decrease in their salaries of $68,000 per month.The marketing manager predicts that introducing this sales incentive would increase monthly sales by 200 units.What should be the overall effect on the company's monthly net operating income of this change? Show your work!

Sales Commissions

Payments made to salespersons, often calculated as a percentage of the sales they generate.

Marketing Manager

A professional responsible for overseeing the promotion and selling of a company's products or services, including planning and executing marketing strategies.

- Create and evaluate income statements using the contribution format in different circumstances.

- Determine the effects of decisions related to pricing, cost, and advertising on the net operating income.

Verified Answer

ZK

Learning Objectives

- Create and evaluate income statements using the contribution format in different circumstances.

- Determine the effects of decisions related to pricing, cost, and advertising on the net operating income.

Related questions

Laraia Corporation Has Provided the Following Contribution Format Income Statement ...

Sarratt Corporation's Contribution Margin Ratio Is 62% and Its Fixed ...

Shelhorse Corporation Produces and Sells a Single Product ...

In July, Meers Corporation Sold 3,700 Units of Its Only ...

Wippert Corporation, a Merchandising Company, Reported the Following Results for ...