Asked by Jacob Delgado on May 21, 2024

Verified

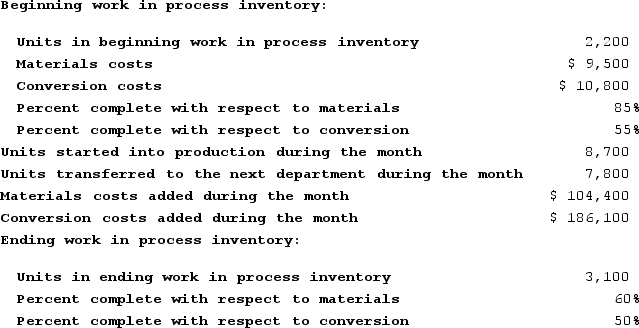

Haffner Corporation uses the weighted-average method in its process costing system. Data concerning the first processing department for the most recent month are listed below:  The cost of ending work in process inventory in the first processing department according to the company's cost system is closest to: (Round "Cost per equivalent unit" to 3 decimal places.)

The cost of ending work in process inventory in the first processing department according to the company's cost system is closest to: (Round "Cost per equivalent unit" to 3 decimal places.)

A) $65,192

B) $54,573

C) $90,043

D) $58,979

Cost System

A method used to allocate costs to products, services, or projects in order to assess financial performance and profitability.

Process Inventory

Inventory that includes all the direct costs and manufacturing overhead involved in the production process until the goods are finished.

- Utilize the method of process costing across diverse scenarios to ascertain cost values.

Verified Answer

BD

Blaise De LimaMay 24, 2024

Final Answer :

B

Explanation :

Using the weighted-average method:

1. Determine the equivalent units of production for direct materials and conversion costs:

Direct materials:

(4,000 units started and completed) + (2,000 units in ending WIP inventory × 50% complete) = 5,000 equivalent units

Conversion costs:

(4,000 units started and completed) + (2,000 units in ending WIP inventory × 60% complete) = 4,800 equivalent units

2. Compute the cost per equivalent unit for direct materials and conversion costs:

Direct materials:

$72,000 ÷ 5,000 equivalent units = $14.40 per equivalent unit

Conversion costs:

$87,000 ÷ 4,800 equivalent units = $18.13 per equivalent unit

3. Allocate costs to units completed and transferred out and to ending work in process inventory:

Direct materials:

$14.40 × 4,000 units = $57,600

$14.40 × 2,000 units × 50% = $7,200

Conversion costs:

$18.13 × 4,000 units = $72,520

$18.13 × 2,000 units × 60% = $21,792

Total cost of ending work in process inventory:

$7,200 + $21,792 = $29,992

Therefore, the cost of ending work in process inventory in the first processing department according to the company's cost system is closest to $54,573. (Option B).

1. Determine the equivalent units of production for direct materials and conversion costs:

Direct materials:

(4,000 units started and completed) + (2,000 units in ending WIP inventory × 50% complete) = 5,000 equivalent units

Conversion costs:

(4,000 units started and completed) + (2,000 units in ending WIP inventory × 60% complete) = 4,800 equivalent units

2. Compute the cost per equivalent unit for direct materials and conversion costs:

Direct materials:

$72,000 ÷ 5,000 equivalent units = $14.40 per equivalent unit

Conversion costs:

$87,000 ÷ 4,800 equivalent units = $18.13 per equivalent unit

3. Allocate costs to units completed and transferred out and to ending work in process inventory:

Direct materials:

$14.40 × 4,000 units = $57,600

$14.40 × 2,000 units × 50% = $7,200

Conversion costs:

$18.13 × 4,000 units = $72,520

$18.13 × 2,000 units × 60% = $21,792

Total cost of ending work in process inventory:

$7,200 + $21,792 = $29,992

Therefore, the cost of ending work in process inventory in the first processing department according to the company's cost system is closest to $54,573. (Option B).

Learning Objectives

- Utilize the method of process costing across diverse scenarios to ascertain cost values.

Related questions

Haffner Corporation Uses the Weighted-Average Method in Its Process Costing ...

Custom-Made Goods Would Be Accounted for Using a Process Costing ...

If the Principal Products of a Manufacturing Process Are Identical ...

Raphael's Refining Uses a Weighted Average Process Costing System ...

The Following Data Has Been Provided by Glasco Inc ...