Asked by Mandalyns Watters on Jul 21, 2024

Verified

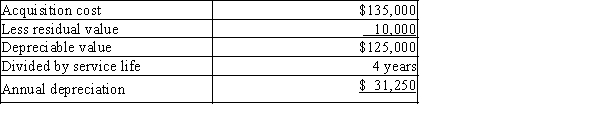

Golden Sales has bought $135,000 in fixed assets on January 1st associated with sales equipment. The residual value of these assets is estimated at $10,000 at the end of their 4-year service life. Golden Sales managers want to evaluate the options of depreciation.

(a) Compute the annual straight-line depreciation and provide the sample depreciation journal entry to be posted

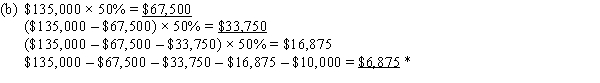

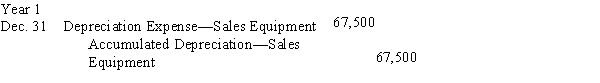

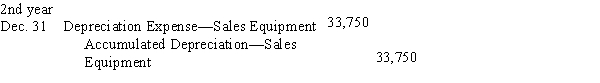

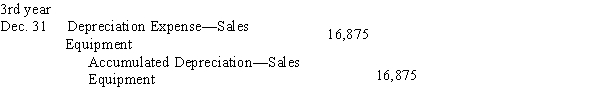

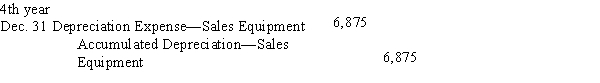

at the end of each of the years.(b) Write the journal entries for each year of the service life for these assets using the double-declining balance

method.

Double-Declining Balance

A method of accelerated depreciation where an asset's value decreases by twice the rate of traditional straight-line depreciation.

Straight-Line Depreciation

A process for dividing the expenditure of a tangible resource into consistent annual portions throughout its service life.

Journal Entries

Records of financial transactions in the accounting system in chronological order.

- Learn the initial concepts of asset depreciation and the components influencing its application.

- Calculate the depreciation expense via the straight-line method and understand its influence on financial statements.

- Employ the double-declining-balance strategy for the calculation of asset depreciation and recognize its repercussions on asset valuation.

Verified Answer

Dec. 31

Dec. 31Depreciation Expense-Sales Equipment

31,250

Accumulated Depreciation-Sales Equipment

31,250

*Depreciation cannot bring book value below $10,000 residual.

*Depreciation cannot bring book value below $10,000 residual.

Learning Objectives

- Learn the initial concepts of asset depreciation and the components influencing its application.

- Calculate the depreciation expense via the straight-line method and understand its influence on financial statements.

- Employ the double-declining-balance strategy for the calculation of asset depreciation and recognize its repercussions on asset valuation.

Related questions

Equipment Costing $80,000 with a Useful Life of 10 Years ...

The Double-Declining-Balance Rate for Calculating Depreciation Expense Is Determined by ...

Machinery Is Purchased on July 1 of the Current Fiscal ...

A Machine Costing $185,000 with a 5-Year Life and $20,000 ...

The Depreciable Cost of a Plant Asset Is Its Original ...