Asked by Joshua Palesano on Jun 15, 2024

Verified

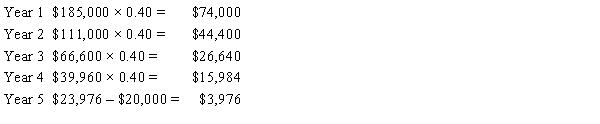

A machine costing $185,000 with a 5-year life and $20,000 residual value was purchased January 2. Compute depreciation for each of the five years, using the double-declining-balance method.

Double-Declining-Balance Method

An accelerated depreciation method that doubles the straight-line depreciation rate, applying it to the remaining book value of an asset each year.

- Obtain insight into the primary understanding of asset depreciation and the factors that contribute to its rate of decline.

- Engage the double-declining-balance methodology for deducing asset depreciation and fathom its effect on the determination of asset worth.

Verified Answer

TK

Learning Objectives

- Obtain insight into the primary understanding of asset depreciation and the factors that contribute to its rate of decline.

- Engage the double-declining-balance methodology for deducing asset depreciation and fathom its effect on the determination of asset worth.

Related questions

Golden Sales Has Bought $135,000 in Fixed Assets on January ...

Equipment Costing $80,000 with a Useful Life of 10 Years ...

The Double-Declining-Balance Rate for Calculating Depreciation Expense Is Determined by ...

Machinery Is Purchased on July 1 of the Current Fiscal ...

The Depreciable Cost of a Plant Asset Is Its Original ...