Asked by Jennifer Feliz on Jun 20, 2024

Verified

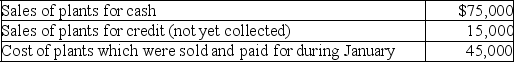

Gail's Greenhouse,Inc. ,a small retail store that sells houseplants,started business on January 1,2019.At the end of January 2019,the following information was available:

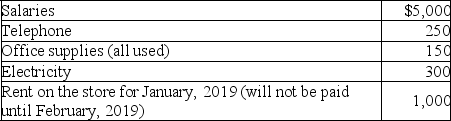

Expenses during January incurred,and paid for,during January unless otherwise noted:

Expenses during January incurred,and paid for,during January unless otherwise noted:

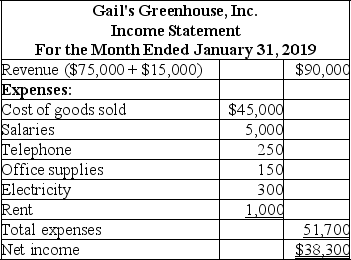

A.Using the above information,prepare the income statement for Gail's Greenhouse for the month ended January 31,2019.

A.Using the above information,prepare the income statement for Gail's Greenhouse for the month ended January 31,2019.

B.What is the amount of cash flows provided by operating activities to be presented on the statement of cash flows?

Income Statement

A financial statement that shows a company's revenues and expenses over a specific period, leading to the net profit or loss.

Operating Activities

These involve the primary revenue-generating activities of an entity, such as cash flows from selling goods and services.

Cash Flows

This refers to the net amount of cash being transferred into and out of a business, especially in the context of operating, investing, and financing activities.

- Understand the basic principles of preparing financial statements and the effects of certain transactions on these statements.

Verified Answer

B.$38,300 - 15,000 + 1,000 = $24,300;or,alternatively,$75,000 - 45,000 - 5,000 - 250 - 150 - 300 = $24,300

B.$38,300 - 15,000 + 1,000 = $24,300;or,alternatively,$75,000 - 45,000 - 5,000 - 250 - 150 - 300 = $24,300

Learning Objectives

- Understand the basic principles of preparing financial statements and the effects of certain transactions on these statements.

Related questions

Fulton Company Was Established at the Beginning of 2019 When ...

A New Accountant Who Prepared the Financial Statements for Saltech ...

Larson Company Ends Its Recent Year of Operations with $3,500,000 ...

For Each of the Following Items That Appear on the ...

Discuss How Financial Statement Accounts Are Inter-Connected Along with the ...