Asked by Connor Dimarco on Jun 16, 2024

Verified

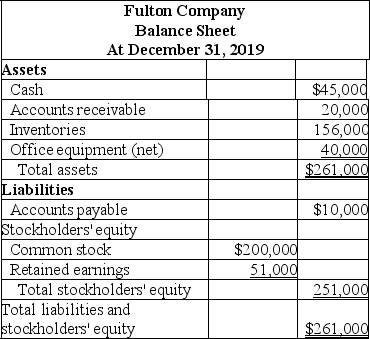

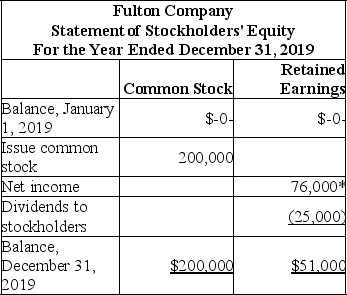

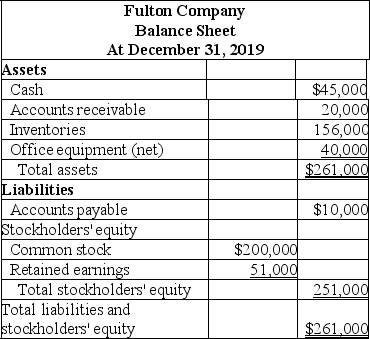

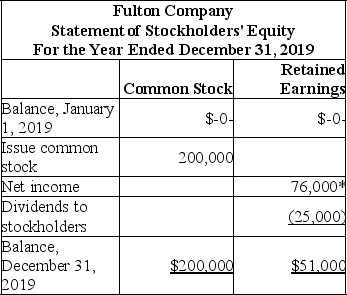

Fulton Company was established at the beginning of 2019 when several investors paid a total of $200,000 to purchase Fulton common stock.No additional investments in common stock were made during the year.By December 31,2019,Fulton had cash on hand of $45,000,office equipment of $40,000,inventory of $156,000,and accounts payable of $10,000.Sales for the year were $812,000.Of this amount,customers still owed $20,000.Fulton declared and paid dividends of $25,000 to its stockholders during 2019.

1.Based on the information above,prepare a balance sheet for Fulton Company at December 31,2019.In the process of preparing the balance sheet,you must calculate the ending balance in retained earnings.

2.Prepare a statement of stockholders' equity for the year ended December 31,2019.

3.What was the amount of Fulton's net income for 2019?

4.Was Fulton successful during its first year in operation? Explain your answer.

Common Stock

Common stock represents units of ownership in a corporation, granting holders voting rights and a share in the company's profits, often through dividends.

Ending Balance

The amount in an account at the end of an accounting period after all debits and credits have been accounted for.

- Acquire knowledge about the core principles underlying the preparation of financial statements and the impact various transactions have on them.

Verified Answer

JH

Jennifer HaddockJun 22, 2024

Final Answer :

1.

2.

2.

3.$76,000 (see statement of stockholders' equity above)

3.$76,000 (see statement of stockholders' equity above)

4.Yes,Fulton's first year was successful.The company earned net income whereas many new companies have losses during early years of operations.Also,Fulton was able to pay dividends to its stockholders.At the end of the first year,the company has just $10,000 in liabilities.It appears to be in sound financial condition.

2.

2. 3.$76,000 (see statement of stockholders' equity above)

3.$76,000 (see statement of stockholders' equity above)4.Yes,Fulton's first year was successful.The company earned net income whereas many new companies have losses during early years of operations.Also,Fulton was able to pay dividends to its stockholders.At the end of the first year,the company has just $10,000 in liabilities.It appears to be in sound financial condition.

Learning Objectives

- Acquire knowledge about the core principles underlying the preparation of financial statements and the impact various transactions have on them.