Asked by Zachary Eierman on May 19, 2024

Verified

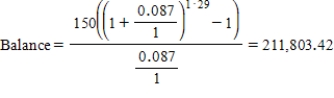

Fulton has been paying $150 per month for a $200,000 whole life insurance policy for the past 29 years.It has a cash value of $128,000.He recently heard that the S&P 500 has averaged an 8.7% annual return over the past 35 years.If he had invested the premiums in stock funds instead,would his balance be enough to offset the death benefit if he died tomorrow?

Whole Life Insurance

A type of insurance that combines a life insurance policy with an investment feature; policyholders pay a premium that is divided between the insurance portion and the investment portion.

Cash Value

The value of the investment portion of a whole life insurance policy.

S&P 500

A stock market index that measures the stock performance of 500 of the largest companies listed on stock exchanges in the United States.

- Determine the accumulated value of investments over a period, factoring in the impact of compounded interest and regular contributions.

- Acquire knowledge of the core aspects of insurance contracts, especially term life insurance, and their financial impact on the insurer and the insured.

Verified Answer

Yes,if Fulton had a crystal ball 29 years ago,he would have been better off to invest it in the S&P 500.

Yes,if Fulton had a crystal ball 29 years ago,he would have been better off to invest it in the S&P 500.

Learning Objectives

- Determine the accumulated value of investments over a period, factoring in the impact of compounded interest and regular contributions.

- Acquire knowledge of the core aspects of insurance contracts, especially term life insurance, and their financial impact on the insurer and the insured.

Related questions

It Is Advisable to Lock in a Term Life Insurance ...

New York Life Sells a Five-Year Term Insurance Policy with ...

Nancy Bought a 20-Year Term Life Insurance Policy with a ...

An Insurance Company Sells a 20-Year Term Life Insurance Policy ...

Carolyn Has Been Contributing $350 Per Month to a Pre-Tax ...