Asked by Hailee Ramirez on May 21, 2024

Verified

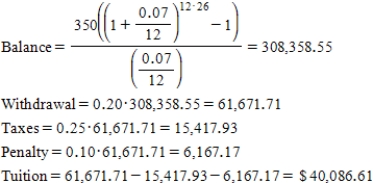

Carolyn has been contributing $350 per month to a pre-tax retirement account since she graduated college at the age of 22.This account has been earning 7% compounded monthly.When she is 48,her youngest child is ready to start college,and Carolyn wants to withdraw 20% of the money in the account for tuition.Carolyn's tax bracket this year is 25%,and she knows she will have to pay a 10% early withdrawal penalty.How much money will she realize to pay for her child's tuition?

Pre-Tax Retirement Account

A savings account designed for retirement that allows individuals to contribute pre-tax income, with taxes deferred until withdrawal.

Compounded Monthly

The process of adding interest to the principal sum of a loan or deposit, where the interest is calculated on a monthly basis.

Early Withdrawal Penalty

A charge applied for taking money out of a financial account or investment before a set date or term has ended.

- Compute the future value of investments, taking into account the effects of compound interest and periodic contributions.

- Compare and contrast IRAs with 401(k) savings plans, particularly in terms of their tax effects.

Verified Answer

CR

Learning Objectives

- Compute the future value of investments, taking into account the effects of compound interest and periodic contributions.

- Compare and contrast IRAs with 401(k) savings plans, particularly in terms of their tax effects.