Asked by David Hornbek Jr. on Jul 11, 2024

Verified

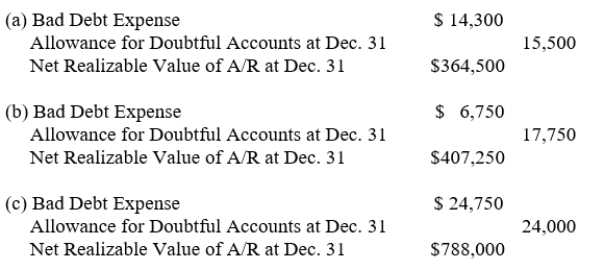

For each of the following scenarios, indicate the amount of the adjusting journal entry for bad debt expense to be recorded, the balance in Allowance for Doubtful Accounts after adjustment at December 31, and the net realizable value of accounts receivable at December 31.(a) Based on an analysis of Simmon's Company's $380,000 balance in Accounts Receivable at December 31, it was estimated that $15,500 will be uncollectible. There is a credit balance of $1,200 in Allowance for Doubtful Accounts before adjustment.(b) Blake Company had credit sales of $900,000 at year-end, and has an Accounts Receivable balance of $425,000 at December 31, and an Allowance for Doubtful Accounts credit balance of $11,000 before adjustment. Blake estimates bad debt expense as 3/4 of 1% of credit sales.(c) Hidgon Inc. has a balance of $812,000 in Accounts Receivable at December 31. An analysis of those receivables shows $24,000 will probably not be collected. Before adjusting entries are prepared, the Allowance for Doubtful Accounts has a debit balance of $750.

Adjusting Journal Entry

An entry made in the accounting journals at the end of an accounting period to allocate items between accounting periods.

Allowance for Doubtful Accounts

An estimate of the amount of accounts receivable that may not be collected, used to reduce the carrying amount of receivables on the balance sheet.

Net Realizable Value

The estimated selling price of goods, minus the costs of their sale or disposal.

- Conduct an analysis and create adjustment entries for bad debt expense utilizing the aging technique and percentage of sales or receivables method.

- Determine the net realizable amount of accounts receivable.

Verified Answer

Learning Objectives

- Conduct an analysis and create adjustment entries for bad debt expense utilizing the aging technique and percentage of sales or receivables method.

- Determine the net realizable amount of accounts receivable.

Related questions

A Partially Completed Aging of Receivables Schedule for Lindy Designs ...

A Company Has $80,000 in Outstanding Accounts Receivable and It ...

The Percent of Sales Method of Estimating Bad Debts Focuses ...

A Company Using the Percentage of Sales Method for Estimating ...

The Percent of Sales Method for Estimating Bad Debts Assumes ...