Asked by Maurice Edwards on Jul 21, 2024

Verified

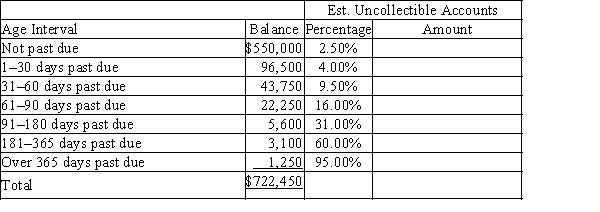

A partially completed aging of receivables schedule for Lindy Designs is shown below.

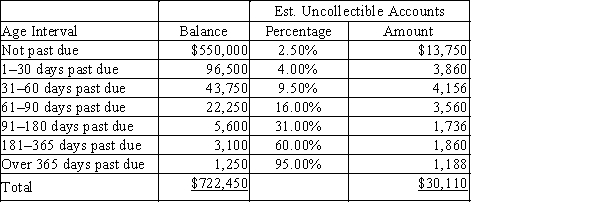

(a) Determine the amount estimated to be uncollectible by completing the aging of receivables schedule. Round calculations to the nearest dollar.  (b) If the Allowance for Doubtful Accounts has a credit balance of $9,700, record the adjusting entry for the bad debt expense for the year.(c) If the Allowance for Doubtful Accounts has a debit balance of $9,700, record the adjusting entry for the bad debt expense for the year.

(b) If the Allowance for Doubtful Accounts has a credit balance of $9,700, record the adjusting entry for the bad debt expense for the year.(c) If the Allowance for Doubtful Accounts has a debit balance of $9,700, record the adjusting entry for the bad debt expense for the year.

Aging of Receivables

Aging of receivables is an accounting method used to estimate the amount of a company's accounts receivable that may not be collectible, represented in time categories based on the length of time the invoices have been outstanding.

Allowance for Doubtful Accounts

A contra-asset account used to estimate the portion of a company's receivables that may not be collected.

Bad Debt Expense

A ledger showing the value of invoices that a business anticipates it will not be able to receive payment for.

- Review and establish adjusting entries for uncollectible debt expense by adopting the aging method and percentage of sales or receivables formula.

Verified Answer

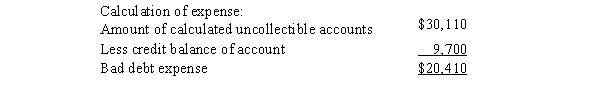

(b) Dec. 31 Bad Debt Expense 20,410

(b) Dec. 31 Bad Debt Expense 20,410Allowance for Doubtful Accounts 20,410

(c) Dec. 31 Bad Debt Expense 39,810

(c) Dec. 31 Bad Debt Expense 39,810Allowance for Doubtful Accounts 39,810

Calculation of expense:

Amount of calculated uncollectible accounts

$30,110

Plus debit balance of account

9,700

Bad debt expense

$39,810

Learning Objectives

- Review and establish adjusting entries for uncollectible debt expense by adopting the aging method and percentage of sales or receivables formula.

Related questions

For Each of the Following Scenarios, Indicate the Amount of ...

The Percent of Sales Method of Estimating Bad Debts Focuses ...

The Percent of Sales Method for Estimating Bad Debts Assumes ...

A Company Using the Percentage of Sales Method for Estimating ...

Installment Accounts Receivable Is Another Name for Aging of Accounts ...