Asked by Hunain Nadeem on May 21, 2024

Verified

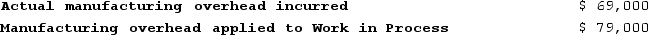

Faughn Corporation has provided the following data concerning manufacturing overhead for July:  The company's Cost of Goods Sold was $243,000 prior to closing out its Manufacturing Overhead account. The company closes out its Manufacturing Overhead account to Cost of Goods Sold. Which of the following statements is true?

The company's Cost of Goods Sold was $243,000 prior to closing out its Manufacturing Overhead account. The company closes out its Manufacturing Overhead account to Cost of Goods Sold. Which of the following statements is true?

A) Manufacturing overhead was underapplied by $10,000; Cost of Goods Sold after closing out the Manufacturing Overhead account is $233,000

B) Manufacturing overhead was overapplied by $10,000; Cost of Goods Sold after closing out the Manufacturing Overhead account is $233,000

C) Manufacturing overhead was overapplied by $10,000; Cost of Goods Sold after closing out the Manufacturing Overhead account is $253,000

D) Manufacturing overhead was underapplied by $10,000; Cost of Goods Sold after closing out the Manufacturing Overhead account is $253,000

Manufacturing Overhead

All manufacturing costs other than direct materials and direct labor, including costs related to running the factory.

Underapplied Overhead

A situation in which the allocated manufacturing overhead costs are less than the actual overhead incurred, leading to a variance in costing.

Overapplied Overhead

A situation where the allocated manufacturing overhead costs exceed the actual overhead costs incurred, leading to adjustments in financial reporting.

- Familiarize yourself with the notion of cost of goods sold (COGS) and the adjustments associated with it.

- Examine and determine the influence of underapplied or overapplied manufacturing overhead on the Cost of Goods Sold.

Verified Answer

Learning Objectives

- Familiarize yourself with the notion of cost of goods sold (COGS) and the adjustments associated with it.

- Examine and determine the influence of underapplied or overapplied manufacturing overhead on the Cost of Goods Sold.

Related questions

Beshaw Incorporated Has Provided the Following Data for the Month ...

Cienfuegos Corporation Has Provided the Following Data Concerning Last Month's ...

The Schedule of Cost of Goods Manufactured Contains Three Elements ...

In the Schedule of Cost of Goods Sold, Unadjusted Cost ...

Calculate the Cost of Goods Sold When Beginning Finished Goods ...