Asked by Jakayla Richburg on May 03, 2024

Verified

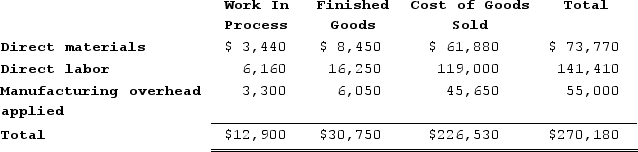

Beshaw Incorporated has provided the following data for the month of January. There were no beginning inventories; consequently, the direct materials, direct labor, and manufacturing overhead applied listed below are all for the current month.  Manufacturing overhead for the month was underapplied by $7,000.The Corporation allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the manufacturing overhead applied during the month in those accounts.The cost of goods sold for January after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to:

Manufacturing overhead for the month was underapplied by $7,000.The Corporation allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the manufacturing overhead applied during the month in those accounts.The cost of goods sold for January after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to:

A) $233,530

B) $220,720

C) $232,340

D) $219,530

Underapplied Manufacturing Overhead

A situation where the actual manufacturing overhead costs are greater than the allocated overhead costs.

Work in Process

The inventory account that tracks costs for incomplete products, which are still in the process of being manufactured.

- Comprehend the principle of cost of goods sold (COGS) and the modifications applied to it.

- Achieve proficiency in computing and understanding the allocation of under or over applied manufacturing overhead costs.

Verified Answer

ZK

Zybrea KnightMay 05, 2024

Final Answer :

C

Explanation :

Direct materials: $70,000

Direct labor: $40,000

Manufacturing overhead applied: $65,000

Total manufacturing costs: $175,000

Add: Work in process inventory, beginning $0

Total cost of work in process $175,000

Less: Work in process inventory, ending $0

Cost of goods manufactured $175,000

Add: Beginning finished goods inventory $0

Cost of goods available for sale $175,000

Less: Ending finished goods inventory $-5,400

Cost of goods sold $232,340

Since manufacturing overhead was underapplied, we need to allocate the underapplied amount of $7,000 back into the three accounts on the basis of the overhead applied during the month. The overhead applied during the month was $65,000 ($70,000 x 92.86%)

Allocation to work in process: $60,292 ($65,000 x 92.68%)

Allocation to finished goods: $4,364 ($65,000 x 6.32%)

Allocation to cost of goods sold: $344 ($7,000 - $4,364 - $60,292)

The adjusted cost of goods sold for January is $232,340 ($232,340 + $344).

Direct labor: $40,000

Manufacturing overhead applied: $65,000

Total manufacturing costs: $175,000

Add: Work in process inventory, beginning $0

Total cost of work in process $175,000

Less: Work in process inventory, ending $0

Cost of goods manufactured $175,000

Add: Beginning finished goods inventory $0

Cost of goods available for sale $175,000

Less: Ending finished goods inventory $-5,400

Cost of goods sold $232,340

Since manufacturing overhead was underapplied, we need to allocate the underapplied amount of $7,000 back into the three accounts on the basis of the overhead applied during the month. The overhead applied during the month was $65,000 ($70,000 x 92.86%)

Allocation to work in process: $60,292 ($65,000 x 92.68%)

Allocation to finished goods: $4,364 ($65,000 x 6.32%)

Allocation to cost of goods sold: $344 ($7,000 - $4,364 - $60,292)

The adjusted cost of goods sold for January is $232,340 ($232,340 + $344).

Learning Objectives

- Comprehend the principle of cost of goods sold (COGS) and the modifications applied to it.

- Achieve proficiency in computing and understanding the allocation of under or over applied manufacturing overhead costs.

Related questions

Crich Corporation Uses Direct Labor-Hours in Its Predetermined Overhead Rate ...

Faughn Corporation Has Provided the Following Data Concerning Manufacturing Overhead ...

Cienfuegos Corporation Has Provided the Following Data Concerning Last Month's ...

In the Schedule of Cost of Goods Sold, Unadjusted Cost ...

The Schedule of Cost of Goods Manufactured Contains Three Elements ...