Asked by Justice Kay-Lease on May 27, 2024

Verified

During 2010, Redford Company acquired a new piece of equipment for its manufacturing process.In order to purchase the equipment, Redford made a down payment of $50, 000 and issued a $200, 000 five-year, 7% note.The annual payment of principal and interest was to be $48, 778.The market rate of interest for obligations of this kind is 12%.The present value factor for an ordinary annuity of 5 years at 12% is 3.604776.

Required:

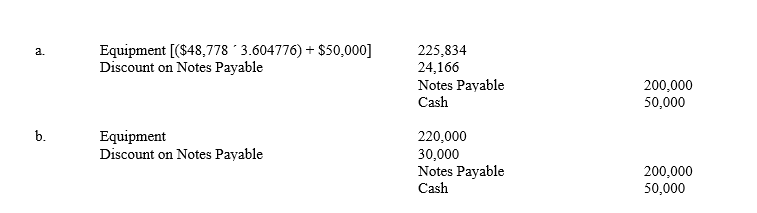

a. Prepare the journal entry to record the acquisition

b. Assume that the equipment had an est ablished cash price of $220,000 \$ 220,000 $220,000 . Prepare the jounal entry to record the transaction under this additional assumption

Present Value Factor

Present value factor is a multiplier used in calculating the present value of a future sum of money or stream of cash flows, given a specified rate of return.

Market Rate

The prevailing interest rate available in the marketplace for instruments of similar risk and maturity.

Down Payment

An initial payment made when something is bought on credit.

- Maintain accounts of acquisitions and upgrades regarding property, manufacturing plants, and machinery through journal logs.

- Calculate and understand the concept of interest capitalization.

Verified Answer

Learning Objectives

- Maintain accounts of acquisitions and upgrades regarding property, manufacturing plants, and machinery through journal logs.

- Calculate and understand the concept of interest capitalization.

Related questions

On August 1, Silver Company Exchanged a Machine for a ...

Smith Delivery Services Bought a Truck by Paying $44, 000 ...

On January 3, 2010, Mercury Company Began Self-Constructing an Asset ...

Discuss When the Interest Capitalization Period Begins and Ends for ...

Cooper, Inc \begin{array}{ll} 2010 & \$ 20,000 \\ 2011 & \$ 60,000 \end{array} Amounts ...