Asked by Terriona Hamilton on Jun 17, 2024

Verified

Cooper, Inc.is constructing a building that qualifies for interest capitalization.The following information is available:

Capitalization period: January 1, 2010-December 31, 2011 Expenditures on project (incurred evenly):

2010$20,0002011$60,000\begin{array}{ll}2010 & \$ 20,000 \\2011 & \$ 60,000\end{array}20102011$20,000$60,000 Amounts borrowed and outstanding (all debt incurred January 1, 2010):

$10,000 at 10% (specifically for the construction project) $18,000 at 12% (general debt) $30,000 at 14% (general debt) \begin{array}{ll}\$ 10,000 & \text { at } 10 \% \text { (specifically for the construction project) } \\\$ 18,000 & \text { at } 12 \% \text { (general debt) } \\\$ 30,000 & \text { at } 14 \% \text { (general debt) }\end{array}$10,000$18,000$30,000 at 10% (specifically for the construction project) at 12% (general debt) at 14% (general debt) Required:

a. Compute the amount of interest that should be capitalized in 2010 and 2011 . (Round interest rates to the ne arest hundredths e.g., 07.62% 07.62 \% 07.62% .)

b. Assume that in 2010 umused borowed funds were invested and eaned interest revemue amounting to $600 \$ 600 $600 . How much interest should be capitalized to the asset account in 2011 ?

Interest Capitalization

The process of adding interest that has accumulated on a loan to the principal balance of the loan, effectively increasing the total amount owed.

Borrowed

Refers to funds or resources obtained through a loan or credit that must be repaid in the future, often with interest.

- Determine and grasp the notion of accruing interest.

Verified Answer

AE

Ashlie ElizabethJun 23, 2024

Final Answer :

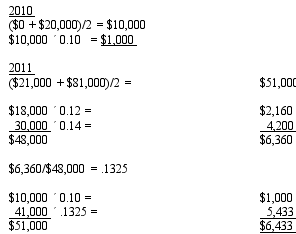

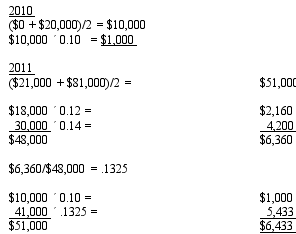

a.2010: $1,000 \$ 1,000 $1,000 , as computed below.

2011: $6,433 \$ 6,433 $6,433 , as compute d below.

b. $1,0000\quad \$ 1,0000$1,0000

2011: $6,433 \$ 6,433 $6,433 , as compute d below.

b. $1,0000\quad \$ 1,0000$1,0000

Learning Objectives

- Determine and grasp the notion of accruing interest.

Related questions

Smith Delivery Services Bought a Truck by Paying $44, 000 ...

During 2010, Redford Company Acquired a New Piece of Equipment \( ...

Discuss When the Interest Capitalization Period Begins and Ends for ...

On January 3, 2010, Mercury Company Began Self-Constructing an Asset ...

On January 1, 2010, Rong Company Signed a Contract to ...