Asked by Aline Rugira on May 27, 2024

Verified

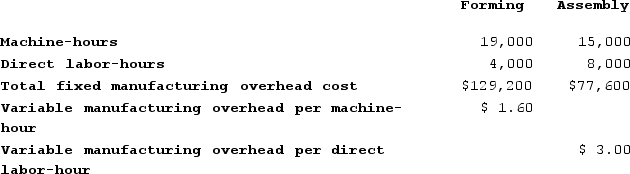

Deloria Corporation has two production departments, Forming and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Forming Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job T288. The following data were recorded for this job:

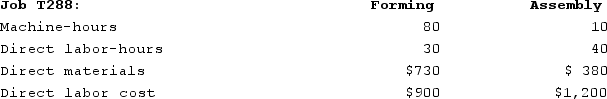

During the current month the company started and finished Job T288. The following data were recorded for this job:

The predetermined overhead rate for the Assembly Department is closest to:

The predetermined overhead rate for the Assembly Department is closest to:

A) $3.00 per direct labor-hour

B) $12.70 per direct labor-hour

C) $9.70 per direct labor-hour

D) $5.35 per direct labor-hour

Assembly Department

A section of a manufacturing firm where products or components are assembled before final packaging or shipping.

Predetermined Overhead Rate

A rate used to apply manufacturing overhead to products or job orders, calculated before the period begins based on estimated costs and activity levels.

Direct Labor-Hours

Overall work duration of employees directly involved in the production process.

- Calculate established overhead rates for assorted production units.

Verified Answer

Predetermined overhead rate = Estimated overhead / Estimated machine-hours = $98,560 / 8,600 = $11.45 per machine-hour

Overhead applied to Job T288 in the Forming Department = $11.45 per machine-hour x 2,100 machine-hours = $24,045

To determine the overhead applied to Job T288 in the Assembly Department, we multiply the predetermined overhead rate by the actual direct labor-hours used:

Predetermined overhead rate = Estimated overhead / Estimated direct labor-hours = $142,560 / 14,800 = $9.62 per direct labor-hour

Overhead applied to Job T288 in the Assembly Department = $9.62 per direct labor-hour x 2,500 direct labor-hours = $24,050

Therefore, the predetermined overhead rate for the Assembly Department is closest to $9.70 per direct labor-hour (choice C is close but not exact).

Learning Objectives

- Calculate established overhead rates for assorted production units.

Related questions

Hickingbottom Corporation Has Two Production Departments, Forming and Finishing ...

Eisentrout Corporation Has Two Production Departments, Machining and Customizing ...

Kalp Corporation Has Two Production Departments, Machining and Finishing ...

Eisentrout Corporation Has Two Production Departments, Machining and Customizing ...

Tarrant Corporation Has Two Manufacturing Departments--Casting and Finishing ...