Asked by Maria Mendez on Jun 24, 2024

Verified

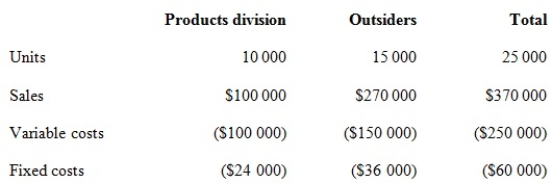

Corporate policy at Weber Pty Ltd requires that all transfers between divisions be recorded at variable cost as a transfer price. Divisional managers have complete autonomy in choosing their sources of customers and suppliers. The Milling Division sells a product called RK2. Forty per cent of the sales of RK2 are to the Products Division, while the remainder of the sales are to outside customers. The manager of the Milling Division is evaluating a special offer from an outside customer for 10 000 units of RK2 at a per unit price of $15.00. If the special offer were accepted, the Milling Division would be unable to supply those units to the Products Division. The Products Division could purchase those units from another supplier for $17 per unit. Annual capacity for the Milling Division is 25 000 units. The 2014 budget information for the Milling Division, based on full capacity, is presented below.

Assume that demand increases for the Milling Division. All 25 000 units can be sold at the regular price to outside customers and the Product Division's annual demand declines to 5000 units. What transfer price would be calculated under the general transfer-pricing formula?

A) $18.00

B) $17.00

C) $16.00

D) $10.00

General Transfer-Pricing Formula

A method or set of guidelines used to determine the price at which goods and services are transferred between departments or divisions within the same company.

Transfer Price

The cost at which products and services are exchanged among departments within the same corporation.

Annual Capacity

The total amount of output or production a company can achieve in a one-year period under normal conditions.

- Acquire knowledge on how to calculate transfer pricing and its impact on decentralized corporations.

- Comprehend the interaction between cost-based and market-based transfer pricing approaches.

Verified Answer

Variable cost per unit = Direct materials + Direct labor + Variable manufacturing overhead = $4 + $3 + $2 = $9

Opportunity cost per unit = The contribution margin per unit that the Milling Division would lose by selling to the outside customer rather than selling to the Products Division.

Contribution margin per unit = Sales price - Variable cost = $20 - $9 = $11

If the Milling Division sells 10,000 units to the outside customer, it will lose the contribution margin on those units, which is $11 x 10,000 = $110,000

The Products Division would have to buy those units from another supplier for $17 per unit, which means that they would have to spend $17 x 10,000 = $170,000

Therefore, the opportunity cost per unit is ($110,000 + $170,000) / 10,000 units = $28

The transfer price would be variable cost + opportunity cost = $9 + $28 = $37

However, since the corporate policy requires that transfers be recorded at variable cost, the transfer price would be $9.

If the Products Division's annual demand declines to 5,000 units, the Milling Division would be able to sell all 25,000 units at the regular price to outside customers. Therefore, the opportunity cost would be zero, and the transfer price would be equal to variable cost, which is $9.

However, if the Mills Division was considering the special offer from the outside customer again, the opportunity cost per unit would be ($11 x 10,000) / 25,000 = $4.40, and the transfer price would be $9 + $4.40 = $13.40.

Learning Objectives

- Acquire knowledge on how to calculate transfer pricing and its impact on decentralized corporations.

- Comprehend the interaction between cost-based and market-based transfer pricing approaches.

Related questions

Fragrance Pty Ltd Has Two Divisions: the Cologne Division and ...

Which of the Following Is a Problem with the Use ...

The Negotiated Price Approach Allows the Managers of Decentralized Units ...

Determining the Transfer Price as the Price at Which the ...

Two of the Decentralized Divisions of Gamberi Electronics Corporation Are ...