Asked by Christopher Robin on Apr 27, 2024

Verified

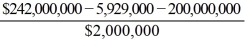

Consider a hedge fund with $200 million at the start of the year. The benchmark S&P 500 Index was up 16.5% during the same period. The gross return on assets is 21%, and the expense ratio is 2%. For each 1% above the benchmark return, the fund managers receive a .1% incentive bonus.

What was the annual return on this fund?

A) 16.5%

B) 18.04%

C) 18.55%

D) 21%

Incentive Bonus

An additional payment or reward given to employees as a motivation for meeting or exceeding specified goals or objectives.

Expense Ratio

A measure of what it costs an investment company to operate a mutual fund, expressed as a percentage of the fund's assets.

Gross Return

The overall yield from an investment prior to subtracting any charges or costs.

- Understand the calculation of returns and evaluations of hedge fund performance.

Verified Answer

MB

Learning Objectives

- Understand the calculation of returns and evaluations of hedge fund performance.

Related questions

Assume That You Have Invested $500,000 to Purchase Shares in ...

You Manage a $15 Million Hedge Fund Portfolio with Beta ...

If the Risk-Free Interest Rate Is Rf and Equals the ...

The Risk Profile of Hedge Funds ______, Making Performance Evaluation ...

Market Neutral Bets Can Result in ______ Volatility Because Hedge ...

= 18.0355%

= 18.0355%