Asked by Achera Weaver on May 10, 2024

Verified

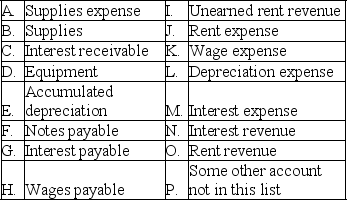

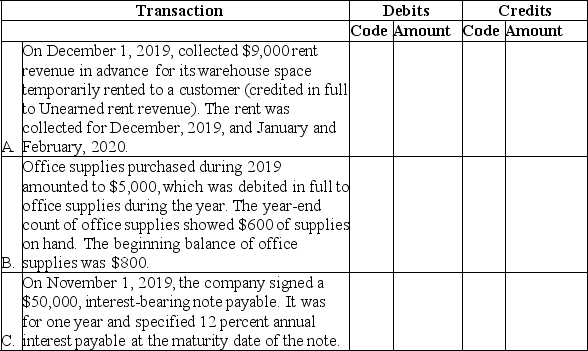

Center Company is completing the accounting cycle at the end of the annual accounting period,December 31,2019.Adjusting entries have not been made during the year so three adjusting entries must be made at this date to update the accounts.The following accounts,selected from Center Company's chart of accounts,are to be used for this purpose.They are coded to the left of each title for convenient reference.

Indicate the appropriate account code and amount for each of the required adjusting entries at December 31,2019.

Indicate the appropriate account code and amount for each of the required adjusting entries at December 31,2019.

Adjusting Entries

Accounting records finalized at the close of an accounting period to properly assign income and expenses to the period they truly belong to.

Annual Accounting Period

A 12-month time span used by businesses for financial reporting and accounting purposes.

Chart of Accounts

A systematic listing of all ledger account names and numbers used by a company, organized by the assets, liabilities, equity, revenue, and expenses.

- Mobilize principles of accounting to establish adjusting entries for accrual and deferral transactions.

Verified Answer

DB

destiny bravoMay 17, 2024

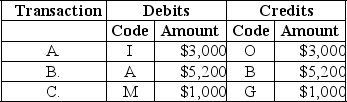

Final Answer :  A.($9,000 × 1/3)= $3,000.

A.($9,000 × 1/3)= $3,000.

B.($800 + 5,000 - 600)= $5,200.

C.($50,000 × 12% × 2/12)= $1,000.

A.($9,000 × 1/3)= $3,000.

A.($9,000 × 1/3)= $3,000.B.($800 + 5,000 - 600)= $5,200.

C.($50,000 × 12% × 2/12)= $1,000.

Learning Objectives

- Mobilize principles of accounting to establish adjusting entries for accrual and deferral transactions.