Asked by Shelby Wilcox on Jul 28, 2024

Verified

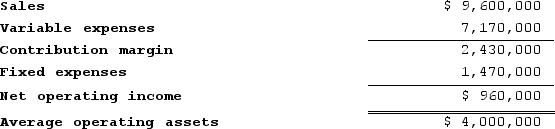

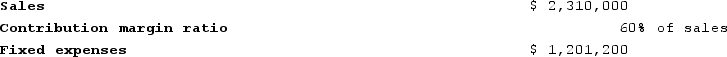

Canedo Incorporated reported the following results from last year's operations:  At the beginning of this year, the company has a $700,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $700,000 investment opportunity with the following characteristics:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined turnover for the entire company will be closest to:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined turnover for the entire company will be closest to:

A) 2.98

B) 17.01

C) 2.53

D) 2.04

Turnover

The rate at which inventory is sold and replaced or an employee leaves and is replaced within a company.

- Ascertain and clarify the meaning of turnover with respect to investment and operational aspects of a company.

- Interpret the impact of various financial opportunities on company turnover and margin.

Verified Answer

SV

Shubham VermaJul 28, 2024

Final Answer :

C

Explanation :

To find the combined turnover for the entire company, we need to calculate the company's total revenue with and without the investment opportunity and add them together.

Without the investment opportunity, the company's total revenue would be $2,000,000 + $1,500,000 = $3,500,000.

With the investment opportunity, the company's total revenue would be $2,000,000 + $1,500,000 + ($700,000 x 0.5) = $4,200,000.

Therefore, the combined turnover for the entire company would be $3,500,000 + $4,200,000 = $7,700,000.

Next, we need to find the turnover ratio by dividing the combined turnover by the average total assets, which is ($5,200,000 + $6,400,000)/2 = $5,800,000.

Turnover ratio = $7,700,000/$5,800,000 = 1.33.

Finally, to convert the turnover ratio to times, we take the reciprocal:

Times = 1/1.33 = 0.75.

Therefore, the combined turnover for the entire company is closest to 2.53 times (0.75 x 3.37).

The answer is choice C (2.53).

Without the investment opportunity, the company's total revenue would be $2,000,000 + $1,500,000 = $3,500,000.

With the investment opportunity, the company's total revenue would be $2,000,000 + $1,500,000 + ($700,000 x 0.5) = $4,200,000.

Therefore, the combined turnover for the entire company would be $3,500,000 + $4,200,000 = $7,700,000.

Next, we need to find the turnover ratio by dividing the combined turnover by the average total assets, which is ($5,200,000 + $6,400,000)/2 = $5,800,000.

Turnover ratio = $7,700,000/$5,800,000 = 1.33.

Finally, to convert the turnover ratio to times, we take the reciprocal:

Times = 1/1.33 = 0.75.

Therefore, the combined turnover for the entire company is closest to 2.53 times (0.75 x 3.37).

The answer is choice C (2.53).

Learning Objectives

- Ascertain and clarify the meaning of turnover with respect to investment and operational aspects of a company.

- Interpret the impact of various financial opportunities on company turnover and margin.

Related questions

Babak Industries Is a Division of a Major Corporation ...

Chavin Company Had the Following Results During August: Net Operating ...

Tallon Incorporated Has a $1,200,000 Investment Opportunity That Involves Sales ...

The Millard Division's Operating Data for the Past Two Years ...

The Company's Total Asset Turnover for Year 2 Is Closest ...