Asked by Kayla Harrington on May 06, 2024

Verified

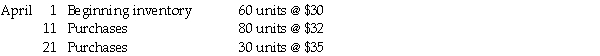

Calculate the ending inventory under each of the following methods given the information below about purchases and sales during the year. Assume a periodic inventory system. Round to four decimal places.  Sales for April: 115 units

Sales for April: 115 units

a) ________ FIFO

b) ________ LIFO

c) ________ Weighted-average

FIFO

An inventory valuation method, "First-In, First-Out", where goods first bought are the first to be sold.

LIFO

Last In, First Out; an inventory valuation method where the items acquired last are the first to be sold.

Weighted-Average

A statistical method used to attribute different weights to data points or components based on their significance.

- Gain an understanding of different techniques for valuing inventory such as FIFO, LIFO, Specific Invoice, and Weighted-average.

- Understand the computation and recording of inventory costs across different inventory management systems.

- Understand the impact of inventory valuation on financial statements and its influence on business decision-making.

Verified Answer

ZK

Zybrea KnightMay 08, 2024

Final Answer :

Available for sale = 60 + 80 + 30 = 170; ending inventory = 170 - 115 = 55 units

a) FIFO (30 × $35) + (25 × $32) = $1,850

b) LIFO (55 × $30) = $1,650

c) Weighted-average [(60 × $30) + (80 × $32) + (30 × $35)] = $5,410/170 × 55 = $1,750.29

a) FIFO (30 × $35) + (25 × $32) = $1,850

b) LIFO (55 × $30) = $1,650

c) Weighted-average [(60 × $30) + (80 × $32) + (30 × $35)] = $5,410/170 × 55 = $1,750.29

Learning Objectives

- Gain an understanding of different techniques for valuing inventory such as FIFO, LIFO, Specific Invoice, and Weighted-average.

- Understand the computation and recording of inventory costs across different inventory management systems.

- Understand the impact of inventory valuation on financial statements and its influence on business decision-making.

Related questions

The _________ Method Assumes the Goods Purchased First Are Sold ...

A Beginning Inventory and Purchases of Desks Follow: the ...

Items That Are Very Similar, Such as Grains and Fuels ...

Under the Specific Invoice Method, Costs Are Matched with Individual ...

The Inventory Method Where Unit Cost Is Found by Dividing ...