Asked by Subash Dahal on May 04, 2024

Verified

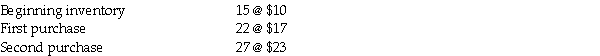

A beginning inventory and purchases of desks follow:  The company sold 11 units from beginning inventory, 16 units from the first purchase, and 21 units from the second purchase.

The company sold 11 units from beginning inventory, 16 units from the first purchase, and 21 units from the second purchase.

Required: Determine the (a) cost of an ending inventory and (b) Cost of Goods Sold under the specific invoice method. Round to two decimal places if required.

Specific Invoice Method

A method used in inventory and cost accounting to specifically track the cost associated with individual inventory items.

Cost of Goods Sold

The direct costs attributable to the production of the goods sold by a company, including material and labor expenses.

Ending Inventory

The total value of goods available for sale at the end of an accounting period, calculated by adding new purchases to beginning inventory and subtracting costs of goods sold.

- Acquire knowledge on the diverse approaches to inventory valuation, like FIFO, LIFO, Specific Invoice, and Weighted-average.

- Acquire knowledge on the calculation and documentation of inventory expenses through various inventory systems.

- Interpret how inventory valuation affects financial statements and business decisions.

Verified Answer

b) COGS: (11 × $10) + (16 × $17) + (21 × $23) = $865

Learning Objectives

- Acquire knowledge on the diverse approaches to inventory valuation, like FIFO, LIFO, Specific Invoice, and Weighted-average.

- Acquire knowledge on the calculation and documentation of inventory expenses through various inventory systems.

- Interpret how inventory valuation affects financial statements and business decisions.

Related questions

The _________ Method Assumes the Goods Purchased First Are Sold ...

Calculate the Ending Inventory Under Each of the Following Methods ...

Items That Are Very Similar, Such as Grains and Fuels ...

Under the Specific Invoice Method, Costs Are Matched with Individual ...

The Inventory Method Where Unit Cost Is Found by Dividing ...