Asked by Ujjwal Dhakal on May 10, 2024

Verified

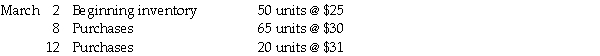

Calculate the cost of goods sold under each of the following methods given the information below about purchases and sales during the year. Assume a periodic inventory system. Use four decimal places.  Sales for March: 95 units

Sales for March: 95 units

a) ________ FIFO

b) ________ LIFO

c) ________ Weighted-average

Periodic Inventory System

A periodic inventory system is an accounting method where inventory and cost of goods sold are calculated at set intervals, such as monthly or annually.

FIFO

A method of inventory valuation where the first items purchased are the first ones to be sold.

LIFO

A method of inventory valuation where the last items added to inventory are the first ones to be used or sold, standing for Last In, First Out.

- Acquire knowledge of the elementary concepts and processes for calculating the cost of goods sold.

- Gain an understanding of the contrasts between the FIFO, LIFO, and weighted-average techniques for inventory costing.

Verified Answer

b) LIFO (20 × $31) + (65 × $30) + (10 × $25) = $2,820

c) Weighted-average [(50 × $25) + (65 × $30) + (20 × $31)] = $3,820/135 × 95 = $2,688.15

Learning Objectives

- Acquire knowledge of the elementary concepts and processes for calculating the cost of goods sold.

- Gain an understanding of the contrasts between the FIFO, LIFO, and weighted-average techniques for inventory costing.

Related questions

A Business Has Sales of $184,158 and a Normal Gross ...

LIFO Provides an Up-To-Date Ending Inventory on the Income Statement ...

A Beginning Inventory and Purchases of Computer Parts Follow ...

When Using the FIFO Inventory Costing Method, the Most Recent ...

FIFO Is the Inventory Costing Method That Follows the Physical ...