Asked by Kiasha Trammell on Jun 06, 2024

Verified

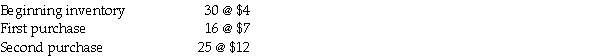

A beginning inventory and purchases of computer parts follow:  The company sold 20 units from beginning inventory, 5 units from the first purchase, and 18 units from the second purchase.

The company sold 20 units from beginning inventory, 5 units from the first purchase, and 18 units from the second purchase.

Required: Determine the (a) cost of an ending inventory and (b) Cost of Goods Sold under the specific invoice method. Round to two decimal places if required.

Specific Invoice Method

An inventory valuation method that tracks each item in inventory by its specific cost and invoice.

Ending Inventory

The total value of goods available for sale at the end of the accounting period, calculated by adding purchases to the beginning inventory and subtracting the cost of goods sold.

Cost of Goods Sold

Expenses directly related to the production of the goods sold by a business, including material costs and direct labor, crucial for calculating gross profit.

- Understand the basic concept and calculation of the cost of goods sold.

- Understand the specific invoice method and its application in inventory costing.

Verified Answer

DS

Daniel StubyJun 09, 2024

Final Answer :

a) Ending Inventory: (10 × $4) + (11 × $7) + (7 × $12) = $201

b) COGS: (20 × $4) + (5 × $7) + (18 × $12) = $331

b) COGS: (20 × $4) + (5 × $7) + (18 × $12) = $331

Learning Objectives

- Understand the basic concept and calculation of the cost of goods sold.

- Understand the specific invoice method and its application in inventory costing.