Asked by Katie Uittenbogaard on Jun 14, 2024

Verified

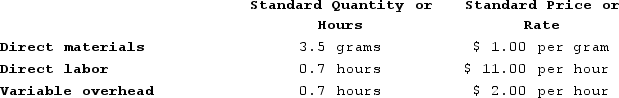

Bulluck Corporation makes a product with the following standard costs:  The company reported the following results concerning this product in July.

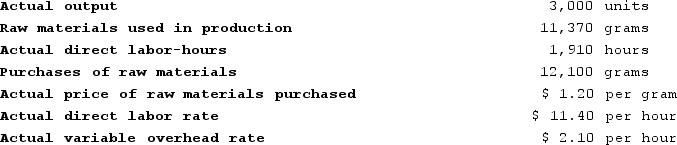

The company reported the following results concerning this product in July.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The materials price variance for July is:

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The materials price variance for July is:

A) $2,100 Unfavorable

B) $2,420 Favorable

C) $2,100 Favorable

D) $2,420 Unfavorable

Standard Costs

These are predetermined costs of manufacturing a single unit or a number of units of a product during a specific period, based on expected material, labor, and overhead costs.

Price Variance

A variance that is computed by taking the difference between the actual price and the standard price and multiplying the result by the actual quantity of the input.

Direct Labor-Hours

The total hours worked by direct labor employees on the production of goods or delivery of services.

- Cultivate an expertise in analyzing and conceptualizing direct materials variances, with emphasis on unraveling the specifics of materials price and quantity discrepancies.

Verified Answer

LG

Leydi Garcia TrecheJun 19, 2024

Final Answer :

D

Explanation :

To calculate the materials price variance, we need to use the formula:

Materials price variance = (Actual price - Standard price) x Actual quantity purchased

We are given the following information for July:

Actual quantity purchased = 17,000 pounds

Actual price paid = $12.20 per pound

The standard price is given as $12.00 per pound.

Substituting the values in the formula, we get:

Materials price variance = ($12.20 - $12.00) x 17,000

= $340 F

Therefore, the materials price variance for July is $340 favorable. However, we need to be careful as the question is asking for the materials price variance, not the total materials variance. To get the materials price variance, we isolate the price difference between the actual and standard quantity, and this gives us a favorable variance as the actual price is lower than the standard price. Therefore, the correct answer is option D, $2,420 unfavorable.

Materials price variance = (Actual price - Standard price) x Actual quantity purchased

We are given the following information for July:

Actual quantity purchased = 17,000 pounds

Actual price paid = $12.20 per pound

The standard price is given as $12.00 per pound.

Substituting the values in the formula, we get:

Materials price variance = ($12.20 - $12.00) x 17,000

= $340 F

Therefore, the materials price variance for July is $340 favorable. However, we need to be careful as the question is asking for the materials price variance, not the total materials variance. To get the materials price variance, we isolate the price difference between the actual and standard quantity, and this gives us a favorable variance as the actual price is lower than the standard price. Therefore, the correct answer is option D, $2,420 unfavorable.

Learning Objectives

- Cultivate an expertise in analyzing and conceptualizing direct materials variances, with emphasis on unraveling the specifics of materials price and quantity discrepancies.