Asked by Martin Sanchez on Jul 12, 2024

Verified

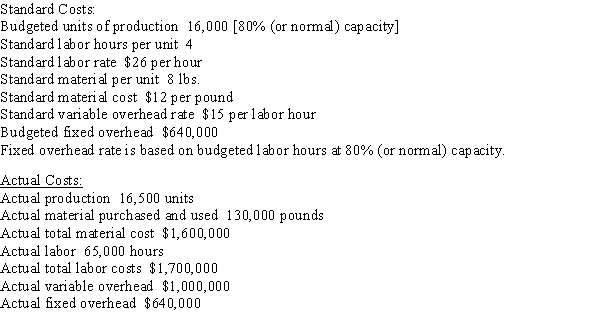

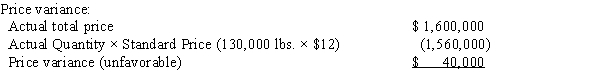

The following information is for the standard and actual costs for Happy Corporation:  Determine (a) the direct materials quantity variance, price variance, and total cost variance; (b) the direct labor time variance, rate variance, and total cost variance; and (c) the factory overhead volume variance, controllable variance, and total factory overhead cost variance.(Note: Do not round interim calculations.)

Determine (a) the direct materials quantity variance, price variance, and total cost variance; (b) the direct labor time variance, rate variance, and total cost variance; and (c) the factory overhead volume variance, controllable variance, and total factory overhead cost variance.(Note: Do not round interim calculations.)

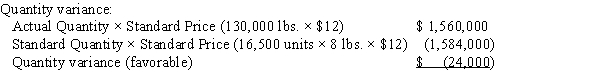

Direct Materials Quantity Variance

The difference between the actual quantity of materials used in production and the standard quantity expected, multiplied by the standard cost per unit.

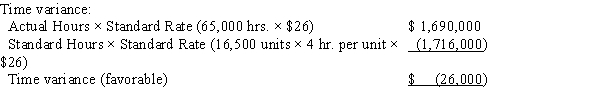

Direct Labor Time Variance

The difference between the actual time taken to complete a task and the standard time expected, multiplied by the labor rate.

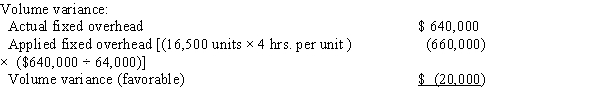

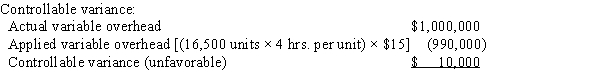

Factory Overhead Volume Variance

The difference between the budgeted and actual volume of production, affecting the allocation of fixed manufacturing overhead costs to products.

- Become proficient in the computation and theories behind direct materials price variance.

- Familiarize yourself with the methodologies and calculations of direct materials quantity variance.

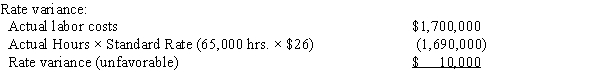

- Gain insight into the methods used to determine direct labor rate and time variances.

Verified Answer

BK

Learning Objectives

- Become proficient in the computation and theories behind direct materials price variance.

- Familiarize yourself with the methodologies and calculations of direct materials quantity variance.

- Gain insight into the methods used to determine direct labor rate and time variances.

b. Direct labor:

b. Direct labor:

c. Factory overhead:

c. Factory overhead: