Asked by Rivaldo English on Jun 10, 2024

Verified

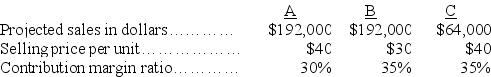

Benjamin Co.has three products A,B,and C,and its fixed costs are $69,000.The sales mix for its products are 3 units of A,4 units of B,and 1 unit of C.Information about the three products follows:

(a)Calculate the company's break-even point in composite units and sales dollars.

(a)Calculate the company's break-even point in composite units and sales dollars.

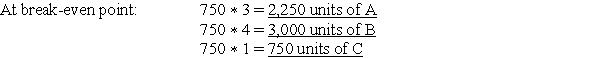

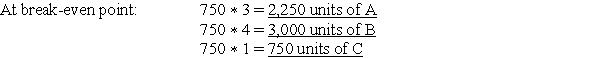

(b)Calculate the number of units of each individual product to be sold at the break-even point.

Composite Units

A measurement or costing method that combines different elements or articles to determine a standard unit rate or cost.

Sales Mix

The proportion of different products or services that a company sells, reflecting the variety and quantities sold.

Fixed Costs

Expenses that do not change in proportion to the level of activity or production, such as rent, salaries, and insurance premiums.

- Learn the rationale and calculation techniques for the break-even point in both unit and monetary sales perspectives.

- Gain an understanding of the role of sales mix in affecting profitability and in conducting break-even analysis.

Verified Answer

IL

Isabel LopezJun 13, 2024

Final Answer :  (a)

(a)

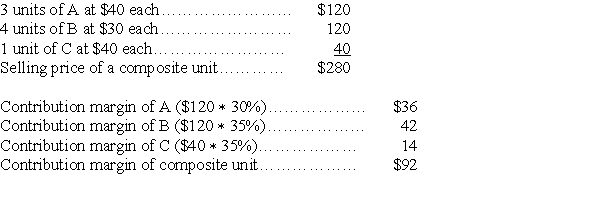

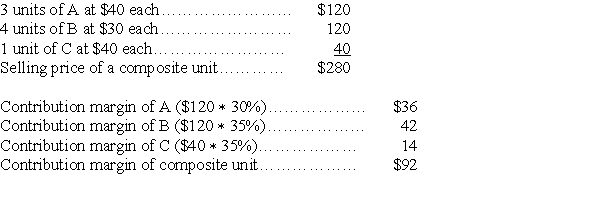

Break-even point in composite units = $69,000/$92 = 750 composite units

Break-even point in sales dollars = 750 ∗ $280 = $210,000

(b)

(a)

(a)Break-even point in composite units = $69,000/$92 = 750 composite units

Break-even point in sales dollars = 750 ∗ $280 = $210,000

(b)

Learning Objectives

- Learn the rationale and calculation techniques for the break-even point in both unit and monetary sales perspectives.

- Gain an understanding of the role of sales mix in affecting profitability and in conducting break-even analysis.