Asked by Jessie Schneider on May 26, 2024

Verified

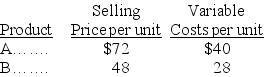

A firm sells two different products,A and B.For each unit of B sold,the firm sells two units of A.Total fixed costs $1,260,000.Additional selling prices and cost information for both products follow:

Required:

Required:

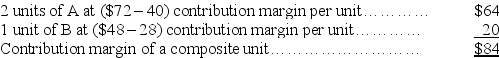

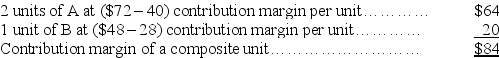

(a)Calculate the contribution margin per composite unit.

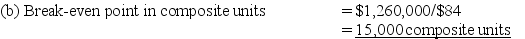

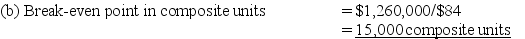

(b)Calculate the break-even point in units of each individual product.

(c)If pretax income before taxes of $294,000 is desired,how many units of A and B must be sold?

Composite Unit

A measurement representing a combination of different but related items, often used in production or inventory management to simplify tracking and analysis.

Break-Even Point

The level of production or sales at which total revenues equal total expenses, resulting in neither a profit nor a loss.

Pretax Income

The amount of income earned by a business before tax is deducted, also known as earnings before tax (EBT).

- Comprehend the principle and computation of the break-even point in terms of both units and monetary sales.

- Comprehend how the composition of sales affects profitability and the analysis of the break-even point.

- Evaluate the dynamics between cost, volume, and profit to tackle business concerns.

Verified Answer

CU

CHRISTOPHER UNIGARROMay 31, 2024

Final Answer :

(a)

(c)Composite units to earn $294,000 in pretax income:

($1,260,000 + $294,000)/$84 = 18,500 composite units

18,500 composite units ∗ 2 = 37,000 units of A‾\underline{\text{37,000 units of A}}37,000 units of A

18,500 composite units ∗ 1 = 18,500 units of B‾\underline{\text{18,500 units of B}}18,500 units of B

(c)Composite units to earn $294,000 in pretax income:

($1,260,000 + $294,000)/$84 = 18,500 composite units

18,500 composite units ∗ 2 = 37,000 units of A‾\underline{\text{37,000 units of A}}37,000 units of A

18,500 composite units ∗ 1 = 18,500 units of B‾\underline{\text{18,500 units of B}}18,500 units of B

Learning Objectives

- Comprehend the principle and computation of the break-even point in terms of both units and monetary sales.

- Comprehend how the composition of sales affects profitability and the analysis of the break-even point.

- Evaluate the dynamics between cost, volume, and profit to tackle business concerns.