Asked by Marcell Randall on Jun 17, 2024

Verified

Bellini Robotics Corporation has developed a new robot-model EM-28-that has been designed to outperform a competitor's best-selling robot. The competitor's product has a useful life of 30,000 hours of service, has operating costs that average $1.40 per hour, and sells for $129,000. In contrast, model EM-28 has a useful life of 90,000 hours of service and its operating cost is $0.80 per hour. Bellini has not yet established a selling price for model EM-28.

Required:

From a value-based pricing standpoint:

a. What is the reference value that Bellini should consider when pricing model EM-28?

b. What is the differentiation value offered by model EM-28 relative to the competitor's offering for each 90,000 hours of service?

c. What is model EM-28's economic value to the customer over its 90,000 hour useful life?

d. What range of possible prices should Bellini consider when setting a price for model EM-28?

Value-based Pricing

A pricing strategy where the price is set based on the perceived or estimated value of a product or service to the customer rather than on the cost of production.

Robot

An automated machine capable of carrying out a complex series of actions automatically, often programmable by a computer.

Operating Cost

Expenditures directly related to the day-to-day operations of a business, including costs for materials, labor, and overhead.

- Learn about the fundamentals of value-based pricing and how it influences the pricing of products.

- Assess the economic advantages afforded to the consumer by a product during its operational life.

- Compute the comparative value of differentiation for a product against its rivals.

Verified Answer

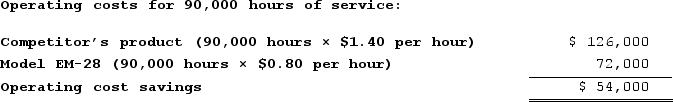

b. The differentiation value has two components. First, customers who purchase a model EM-28 rather than the competing alternative would avoid the need to buy three robots for $129,000 rather than just one EM-28 to achieve 90,000 hours of service. This is a savings of $258,000 (= 2 × $129,000) for the additional robots that would have to be purchased. Second, customers who purchase a model EM-28 rather than the competing alternative would realize operating cost savings computed as follows:

Differentiation value = $258,000 + $54,000 = $312,000

Differentiation value = $258,000 + $54,000 = $312,000c. The economic value to the customer (EVC) is computed as follows:

EVC = Reference value + Differentiation value = $129,000 + $312,000 = $441,000

d. The range of possible prices is as follows:

Reference value ≤ Value-based price ≤ EVC

$129,000 ≤ Value-based price ≤ $441,000

Learning Objectives

- Learn about the fundamentals of value-based pricing and how it influences the pricing of products.

- Assess the economic advantages afforded to the consumer by a product during its operational life.

- Compute the comparative value of differentiation for a product against its rivals.

Related questions

Bochenski Mechanical Corporation Has Developed a New Industrial Grinder-Model UF-48-That ...

Thoen Heavy Machinery Corporation Has Developed a New Drill Press-Model ...

Morice Industries Incorporated Has Developed a New Injection Mold, Model ...

Morice Industries Incorporated Has Developed a New Injection Mold, Model ...

In Value-Based Pricing, the Value of What Differentiates a Product ...