Asked by Charlene Wright on Jul 24, 2024

Verified

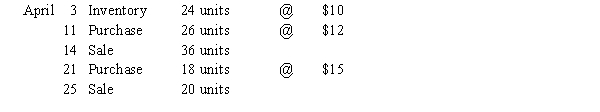

Beginning inventory, purchases and sales data for T-shirts are as follows:  Assuming the business maintains a periodic inventory system, calculate the cost of goods sold and ending inventory under the following assumptions:

Assuming the business maintains a periodic inventory system, calculate the cost of goods sold and ending inventory under the following assumptions:

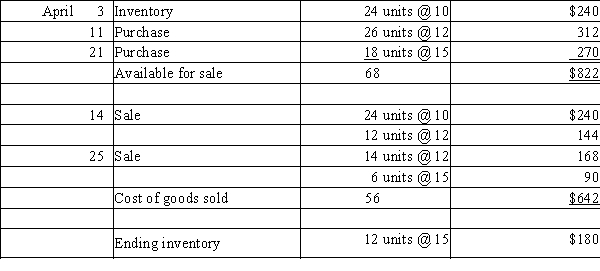

a. FIFO

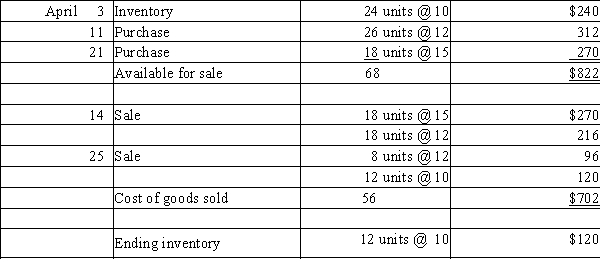

b. LIFO

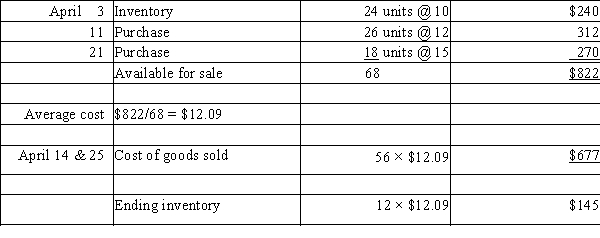

c. Average cost (round cost of goods sold and ending inventory to the nearest dollar)

Periodic Inventory System

An inventory accounting system where updates to inventory levels are made at specific intervals, such as monthly or annually, rather than continuously.

FIFO

"First In, First Out," an inventory valuation method assuming that the oldest items in inventory are sold or used first.

LIFO

A inventory valuation method where the last items added to inventory are the first ones sold, standing for "Last In, First Out."

- Enhance abilities in comprehending and calculating amongst varied inventory accounting techniques, notably FIFO, LIFO, and Average cost.

Verified Answer

Learning Objectives

- Enhance abilities in comprehending and calculating amongst varied inventory accounting techniques, notably FIFO, LIFO, and Average cost.

Related questions

Using the Table Provided, Calculate Total Sales, Cost of Goods ...

Brutus Corporation, a Newly Formed Corporation, Has the Following Transactions ...

The Following Data Were Taken from the Annual Reports of ...

Describe Three Inventory Cost Flow Assumptions and How They Impact ...

The Units of an Item Available for Sale During the ...

b. LIFO

b. LIFO  c. Average cost

c. Average cost