Asked by Jibreel Ahmad on May 17, 2024

Verified

Beckworth Company purchased a truck on January 1,2018,at a cash cost of $10,600.The estimated residual value was $400 and the estimated useful life 4 years.The company uses straight-line depreciation computed monthly.On July 1,2021,the company sold the truck for $1,900 cash.

A.What was the depreciation expense amount per month?

B.What was the amount of accumulated depreciation at July 1,2021?

C.Prepare the required journal entries on the date of disposal,July 1,2021.(Assume no 2021 depreciation had yet been recorded)

Residual Value

The projected worth of an asset upon reaching the end of its serviceable duration.

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life in equal annual amounts, simplifying accounting processes.

Accumulated Depreciation

The total amount of a tangible asset's cost that has been expensed since the asset was put into use, often shown on the balance sheet as a reduction from the asset's historical cost.

- Acquire knowledge of how to account for depreciable assets and revise depreciation estimates.

- Describe the method for documenting the sale or elimination of depreciating assets and the calculation of any associated financial gain or loss.

Verified Answer

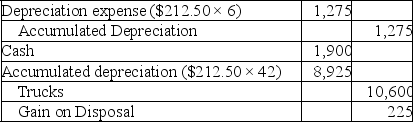

B.$212.50 × 42 months = $8,925

C.

Learning Objectives

- Acquire knowledge of how to account for depreciable assets and revise depreciation estimates.

- Describe the method for documenting the sale or elimination of depreciating assets and the calculation of any associated financial gain or loss.

Related questions

Lue Company Sold Used Equipment for $450,000 Cash ...

If an Asset Is Fully Depreciated and Retired for Proceeds ...

When an Asset Is Sold, a Gain Is Reported That ...

The Oberon Company Purchased a Delivery Truck for $95,000 on ...

Explain the Impact,if Any,on Depreciation When Estimates That Determine Depreciation ...