Asked by Adrianaya Roettger on May 10, 2024

Verified

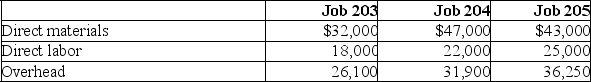

At the end of June,job cost sheets for Kennedy Manufacturing show the following total costs accumulated on three custom jobs:

Job 203 was started in production in May and the following costs were assigned to it in May: direct materials,$12,000; direct labor,$6,000; and overhead $8,700.Jobs 204 and 205 are started in June.Overhead cost is applied with a predetermined rate based on direct labor cost.Jobs 203 and 204 are finished in June,and Job 205 will be finished in July.No raw materials are used indirectly in June.Using this information,answer the following questions assuming the company's predetermined overhead rate did not change.

Job 203 was started in production in May and the following costs were assigned to it in May: direct materials,$12,000; direct labor,$6,000; and overhead $8,700.Jobs 204 and 205 are started in June.Overhead cost is applied with a predetermined rate based on direct labor cost.Jobs 203 and 204 are finished in June,and Job 205 will be finished in July.No raw materials are used indirectly in June.Using this information,answer the following questions assuming the company's predetermined overhead rate did not change.

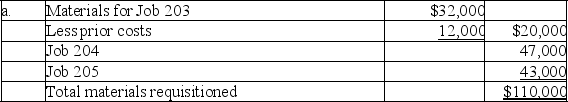

a.What is the total cost of direct materials requisitioned in June for the three jobs?

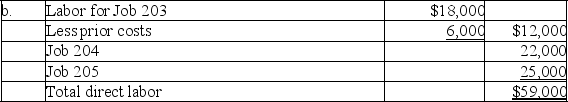

b.What is the total direct labor cost incurred during June for the three jobs?

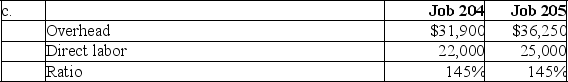

c.What predetermined overhead rate is used during June?

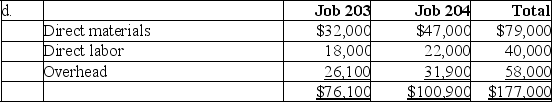

d.How much total cost is transferred to finished goods during June?

Direct Labor

The labor costs directly tied to the production of goods or the performance of services.

Predetermined Overhead

A calculated rate used to estimate the manufacturing overhead costs for a specific period, based on projected or historical data.

Job Cost Sheets

Documents that record and track the costs associated with a specific job or project.

- Calculate direct materials, direct labor, and applied overhead for specific jobs.

- Determine the total cost of production and the cost of goods sold.

- Understand and apply the predetermined overhead rate in job costing.

Verified Answer

Learning Objectives

- Calculate direct materials, direct labor, and applied overhead for specific jobs.

- Determine the total cost of production and the cost of goods sold.

- Understand and apply the predetermined overhead rate in job costing.

Related questions

Which of the Following Is the Correct Formula to Compute ...

Dearden Corporation Uses a Job-Order Costing System with a Single ...

If a Job Is Not Completed at Year End, Then ...

Hultquist Corporation Has Two Manufacturing Departments--Forming and Customizing ...

Vasilopoulos Corporation Has Two Production Departments, Casting and Assembly ...