Asked by Monica De Leon on Jun 28, 2024

Verified

At December 31 2017 the available-for-sale securities for Allison Inc. are as follows. Security ‾ Cost ‾ Fair Value ‾X$27,500$24,000Y 12,50013,000Z23,000‾18,000‾$63,000‾$55,000‾\begin{array}{lrr} \underline{\text { Security }} & \underline{ \text { Cost }}& \underline{ \text { Fair Value }}\\\text {X} & \$ 27,500 & \$ 24,000 \\\text {Y }& 12,500 & 13,000 \\\text {Z} & \underline{23,000} & \underline{18,000} \\&\underline{ \$ 63,000} &\underline{ \$ 55,000}\end{array} Security XY Z Cost $27,50012,50023,000$63,000 Fair Value $24,00013,00018,000$55,000 Instructions

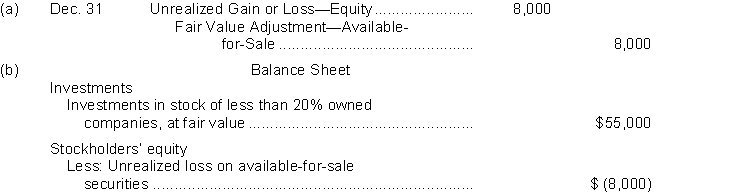

(a) Prepare the adjusting entry at December 31 2017 to report the securities at fair value.

(b) Show the balance sheet and income statement presentation at December 31 2017 after adjustment to fair value. The securities are considered to be a long-term investment.

Long-Term Investment

Investments held for an extended period, typically exceeding one year, such as stocks, bonds, or real estate, aiming for prolonged growth.

Fair Value

A valuation of an asset or liability determined by the price it would fetch if sold, or the cost to transfer it, in a smooth transaction among participants in the market.

Adjusting Entry

A journal entry made at the end of an accounting period to allocate income and expenditures to the appropriate periods.

- Organize and alter bookkeeping entries to represent investments at fair valuation in compliance with GAAP specifications.

- Comprehend the presentation and impacts of investment activities as they appear in the income statement and balance sheet.

- Absorb the methods for handling unrealized gains and losses on securities classified as available for sale.

Verified Answer

Learning Objectives

- Organize and alter bookkeeping entries to represent investments at fair valuation in compliance with GAAP specifications.

- Comprehend the presentation and impacts of investment activities as they appear in the income statement and balance sheet.

- Absorb the methods for handling unrealized gains and losses on securities classified as available for sale.

Related questions

An Unrealized Gain or Loss on Available-For-Sale Securities Is Reported ...

At January 1 2017 the Available-For-Sale Securities Portfolio Held by ...

Presented Below Are Two Independent Situations ...

At December 31 2017 the Trading Securities for Eddy Company ...

At January 1 2017 Grand Corporation Held One Available-For-Sale Security ...