Asked by Andrea Diaz-Rodriguez on May 03, 2024

Verified

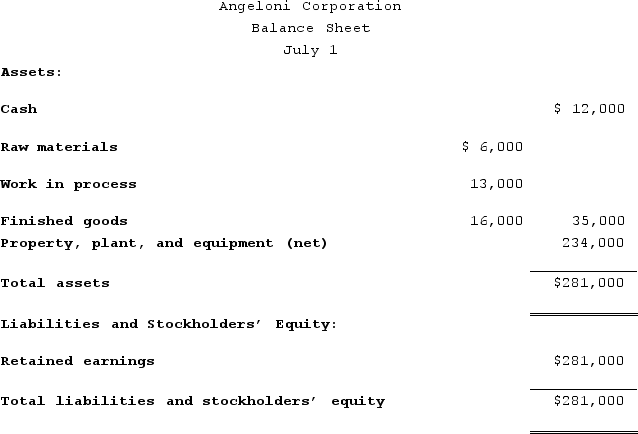

Angeloni Corporation uses a job-order costing system to assign manufacturing costs to jobs. At the end of the month it closes out any overapplied or underapplied manufacturing overhead to Cost of Goods Sold. Its balance sheet on July 1 appears below:

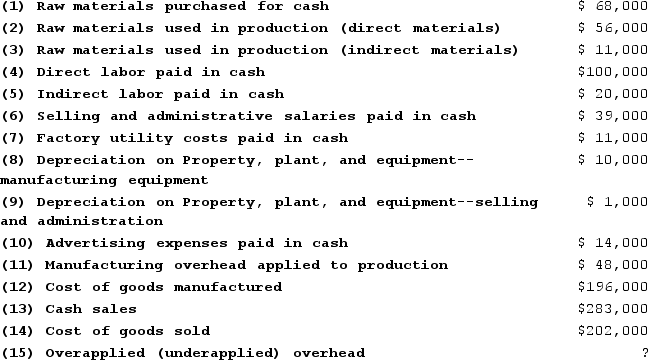

Summaries of the transactions completed during July appear below:

Summaries of the transactions completed during July appear below:

Required:

Required:

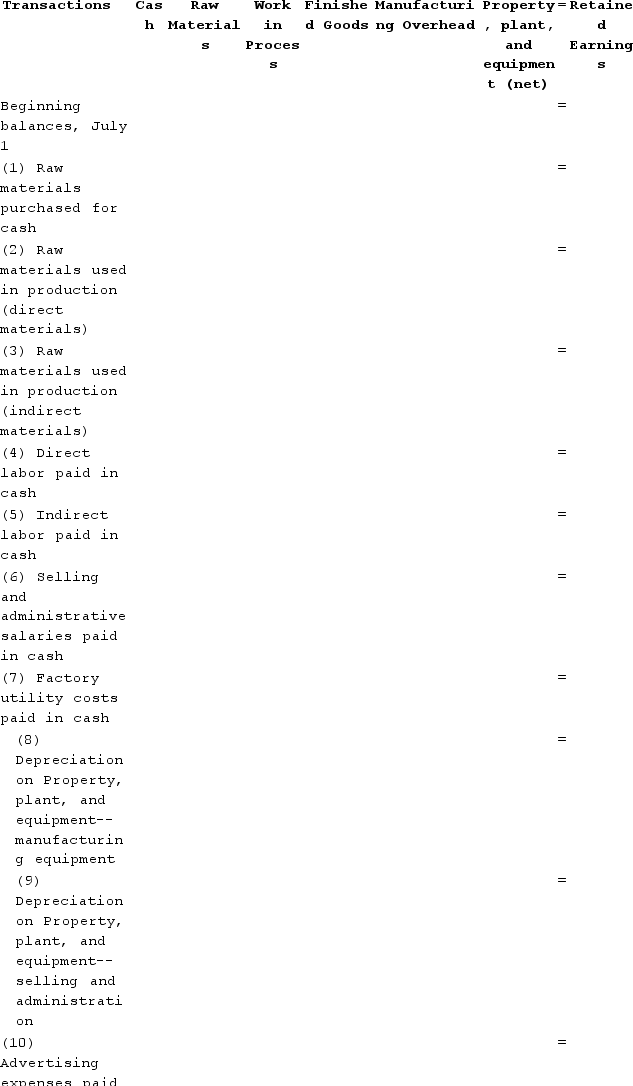

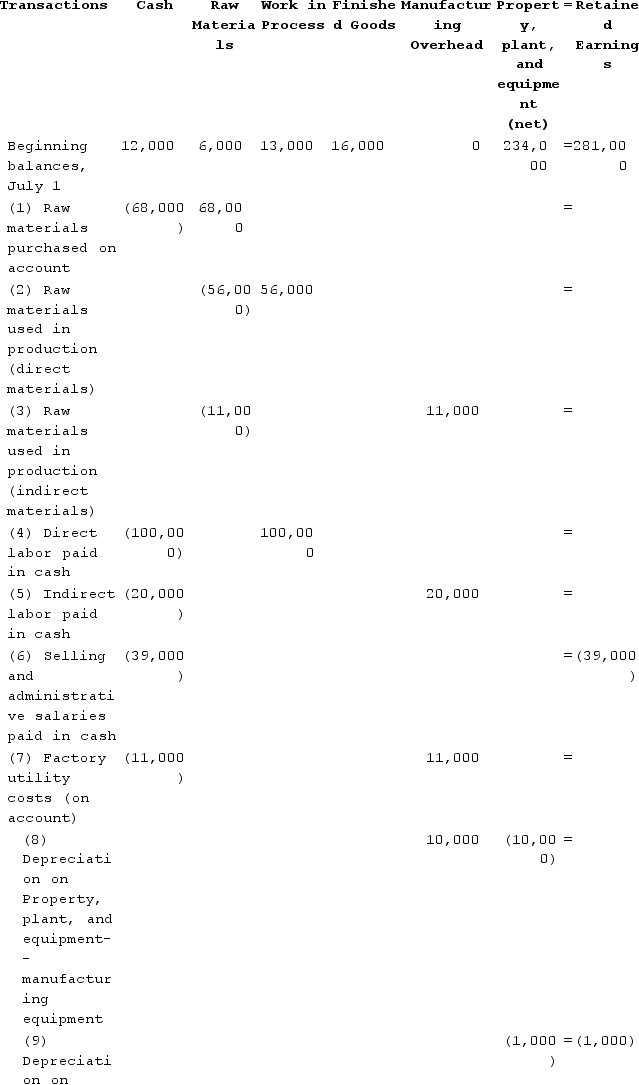

a. Completely fill in the spreadsheet below.

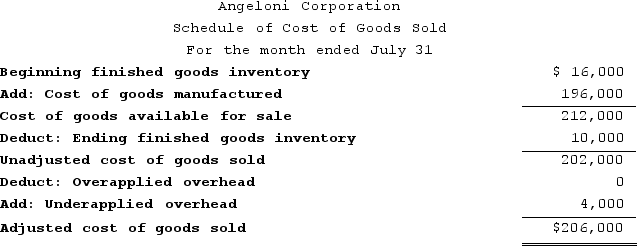

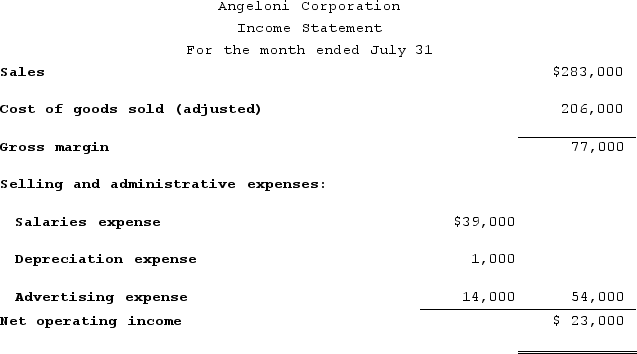

b. Prepare a Schedule of Cost of Goods Sold for the company for July. c. Prepare an Income Statement for the company for July.

b. Prepare a Schedule of Cost of Goods Sold for the company for July. c. Prepare an Income Statement for the company for July.

Job-Order Costing

An accounting method used to track the costs associated with producing specific jobs or batches, assigning material, labor, and overhead costs to each job separately.

Cost of Goods Sold

The direct costs attributed to the production of the goods sold by a company, including direct labor and materials, but excluding indirect expenses.

Balance Sheet

A financial statement that summarizes a company's assets, liabilities, and shareholders' equity at a specific point in time.

- Utilize job-order costing techniques to allocate production expenses to individual jobs.

- Examine and fill out job-costing tables.

- Ready oneself and comprehend the Schedule of Cost of Goods Sold.

Verified Answer

Note: Entry (15), overapplied (underapplied) is a plug figure to make the ending balance in Manufacturing Overhead zero.

Note: Entry (15), overapplied (underapplied) is a plug figure to make the ending balance in Manufacturing Overhead zero.b.

c.

c.

Learning Objectives

- Utilize job-order costing techniques to allocate production expenses to individual jobs.

- Examine and fill out job-costing tables.

- Ready oneself and comprehend the Schedule of Cost of Goods Sold.

Related questions

Sandra Corporation Uses a Job-Order Costing System to Assign Manufacturing ...

Wurzer Corporation Uses a Job-Order Costing System to Assign Manufacturing ...

Amunrud Corporation Uses a Job-Order Costing System to Assign Manufacturing ...

Ferrini Corporation Manufactures One Product ...

Buchauer Corporation Manufactures One Product ...