Asked by Emmanuel Garcia on May 28, 2024

Verified

Anazi Leather Company manufactures leather handbags and moccasins. The company has been using the single plantwide factory overhead rate method but has decided to evaluate the multiple production department factory overhead rate method to allocate factory overhead. The factory overhead estimated per unit together with direct materials and direct labor will help determine selling prices.

Handbags = 60,000 units, 3 hours of direct labor

Moccasins= 40,000 units, 2 hours of direct labor

Total budgeted factory overhead cost = $360,000

The company has two different production departments: Cutting and Sewing. The Cutting Department has a factory overhead budget of $80,000. Each unit will require 1 direct labor hour or a total of 100,000 direct labor hours.

The Sewing Department estimates factory overhead in the amount of $280,000. Handbags require 2 hours of sewing time, and Moccasins require 1 hour for a total of 160,000 direct labor hours.

Using the multiple production department factory overhead rate method, compute the total factory overhead to be allocated to each product using direct labor hours as the allocation base.

Multiple Production Department

Multiple Production Department refers to the various distinct sections within a manufacturing process or facility, each responsible for different stages or types of production.

Factory Overhead Rate

The rate at which indirect manufacturing costs are applied to produced goods, based on a specific allocation base, such as labor hours or machine hours.

Direct Labor Hours

The total hours worked by employees directly involved in the manufacturing or production process.

- Determine the cost of factory overhead per product unit through the allocation of direct labor hours.

- Scrutinize the distribution of total manufacturing overhead costs to product outputs, taking into account planned and actual production volumes.

- Evaluate the advantages of using multiple production department factory overhead rates over a single plantwide rate.

Verified Answer

JJ

Jazmynn JamesMay 31, 2024

Final Answer :

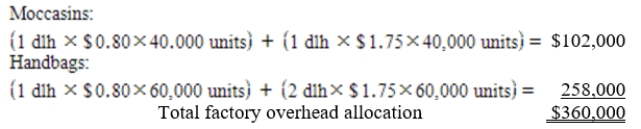

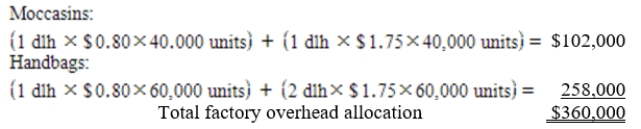

Cutting Department factory overhead rate: $80,000 ÷ 100,000 dlh = $0.80 per dlh

Sewing Department factory overhead rate: $280,000 ÷ 160,000 dlh = $1.75 per dlh

Sewing Department factory overhead rate: $280,000 ÷ 160,000 dlh = $1.75 per dlh

Learning Objectives

- Determine the cost of factory overhead per product unit through the allocation of direct labor hours.

- Scrutinize the distribution of total manufacturing overhead costs to product outputs, taking into account planned and actual production volumes.

- Evaluate the advantages of using multiple production department factory overhead rates over a single plantwide rate.