Asked by Isabella Garcia on Apr 28, 2024

Verified

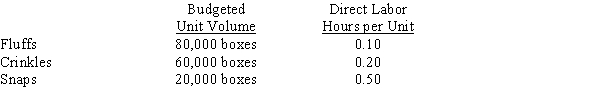

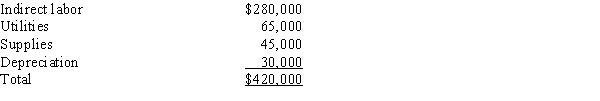

Bugaboo Co. manufactures three types of cookies: Fluffs, Crinkles, and Snaps. The production process is relatively simple, and factory overhead costs are allocated to products using a single plantwide factory overhead rate based on direct labor hours. Information for the month of May, Bugaboo's first month of operations, follows:  Bugaboo has budgeted direct labor costs for May at $8.50 per hour. Budgeted direct materials costs for May are: Fluffs, $0.75/unit; Crinkles $0.40/unit; and Snaps $0.30/unit.Bugaboo's budgeted overhead costs for May are:

Bugaboo has budgeted direct labor costs for May at $8.50 per hour. Budgeted direct materials costs for May are: Fluffs, $0.75/unit; Crinkles $0.40/unit; and Snaps $0.30/unit.Bugaboo's budgeted overhead costs for May are:

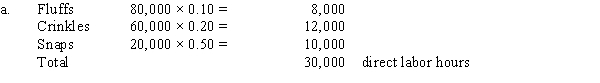

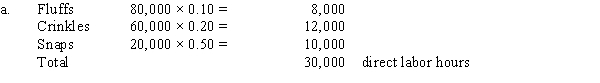

a.Compute Bugaboo's plantwide factory overhead rate for May.

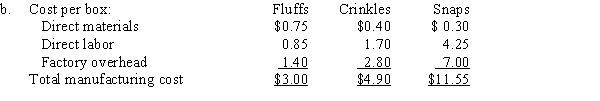

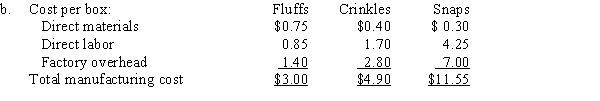

b.Compute the product cost in May for each type of cookie.

c.Does Bugaboo's use of a plantwide factory overhead rate in any way distort the product costs for May?

Plantwide Factory

The application of a single overhead rate to allocate all manufacturing overhead costs uniformly throughout a production plant.

Direct Labor Hours

The total hours worked by employees directly involved in the production of goods or services.

- Comprehend the principle of activity-based costing (ABC) and its significance in precisely allocating costs to products.

- Determine the overhead rates in a manufacturing setting through both single plantwide and multiple departmental methods.

- Acquire knowledge on how factory overhead is assigned to products based on direct labor hours and machine hours.

Verified Answer

LD

Lorena DakdoukApr 29, 2024

Final Answer :  Single Plantwide Factory Overhead Rate = Total Budgeted Factory Overhead ÷ Total Budgeted Plantwide Allocation Base = $420,000 ÷ 30,000 dlh = $14.00 per direct labor hour

Single Plantwide Factory Overhead Rate = Total Budgeted Factory Overhead ÷ Total Budgeted Plantwide Allocation Base = $420,000 ÷ 30,000 dlh = $14.00 per direct labor hour  c.A much higher overhead rate per box is being charged to the product that uses the highest amount of the single allocation base. This may be an incorrect allocation of factory overhead costs.

c.A much higher overhead rate per box is being charged to the product that uses the highest amount of the single allocation base. This may be an incorrect allocation of factory overhead costs.

Single Plantwide Factory Overhead Rate = Total Budgeted Factory Overhead ÷ Total Budgeted Plantwide Allocation Base = $420,000 ÷ 30,000 dlh = $14.00 per direct labor hour

Single Plantwide Factory Overhead Rate = Total Budgeted Factory Overhead ÷ Total Budgeted Plantwide Allocation Base = $420,000 ÷ 30,000 dlh = $14.00 per direct labor hour  c.A much higher overhead rate per box is being charged to the product that uses the highest amount of the single allocation base. This may be an incorrect allocation of factory overhead costs.

c.A much higher overhead rate per box is being charged to the product that uses the highest amount of the single allocation base. This may be an incorrect allocation of factory overhead costs.

Learning Objectives

- Comprehend the principle of activity-based costing (ABC) and its significance in precisely allocating costs to products.

- Determine the overhead rates in a manufacturing setting through both single plantwide and multiple departmental methods.

- Acquire knowledge on how factory overhead is assigned to products based on direct labor hours and machine hours.