Asked by Mireille Mathieu Ebode Nkoudou on Jul 13, 2024

Verified

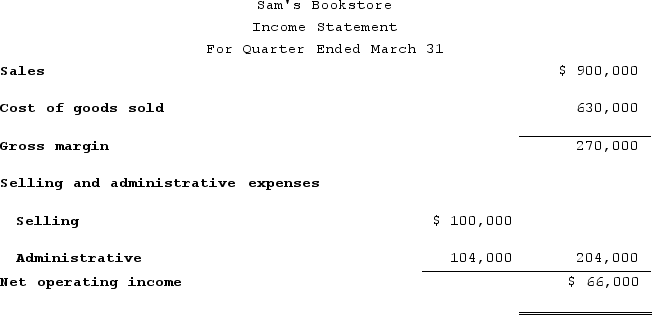

An income statement for Sam's Bookstore for the first quarter of the year is presented below:  On average, a book sells for $50. Variable selling expenses are $5 per book with the remaining selling expenses being fixed. The variable administrative expenses are 4% of sales with the remainder being fixed.The cost formula for selling and administrative expenses with "X" equal to the number of books sold is:

On average, a book sells for $50. Variable selling expenses are $5 per book with the remaining selling expenses being fixed. The variable administrative expenses are 4% of sales with the remainder being fixed.The cost formula for selling and administrative expenses with "X" equal to the number of books sold is:

A) Y = $102,000 + $5X

B) Y = $102,000 + $7X

C) Y = $78,000 + $7X

D) Y = $78,000 + $9X

Cost Formula

An equation used to predict costs at different levels of activity. It often incorporates fixed costs, variable rate per unit of activity, and the total cost.

Administrative Expenses

Overhead or operating expenses associated with the day-to-day operations of a business, excluding production costs.

- Develop equations for cost formulas based on variable and fixed components.

Verified Answer

NG

Nishad GeorgeJul 20, 2024

Final Answer :

C

Explanation :

To find the cost formula for selling and administrative expenses, we need to use the given information about variable and fixed expenses.

Variable Selling Expenses:

We are given that variable selling expenses are $5 per book. Therefore, the formula for variable selling expenses is:

Variable Selling Expenses = $5 x Number of Books Sold

Or, Variable Selling Expenses = $5X

Fixed Selling Expenses:

We are also given that the remaining selling expenses are fixed. The income statement tells us that total selling expenses for the quarter were $102,000. Therefore, we can subtract the variable selling expenses from this total to find the fixed selling expenses:

Fixed Selling Expenses = Total Selling Expenses - Variable Selling Expenses

Or, Fixed Selling Expenses = $102,000 - $5X

Total Selling Expenses:

If we add the variable and fixed selling expenses, we get the total selling expenses formula:

Total Selling Expenses = Fixed Selling Expenses + Variable Selling Expenses

Or, Total Selling Expenses = ($102,000 - $5X) + ($5X)

Simplifying: Total Selling Expenses = $102,000

Variable Administrative Expenses:

We are given that variable administrative expenses are 4% of sales. Therefore, the formula for variable administrative expenses is:

Variable Administrative Expenses = 0.04 x Sales

Or, Variable Administrative Expenses = 0.04 x ($50X)

Simplifying: Variable Administrative Expenses = $2X

Fixed Administrative Expenses:

We are also given that the remainder of administrative expenses are fixed. The income statement tells us that total administrative expenses for the quarter were $26,000. Therefore, we can subtract the variable administrative expenses from this total to find the fixed administrative expenses:

Fixed Administrative Expenses = Total Administrative Expenses - Variable Administrative Expenses

Or, Fixed Administrative Expenses = $26,000 - $2X

Total Administrative Expenses:

If we add the variable and fixed administrative expenses, we get the total administrative expenses formula:

Total Administrative Expenses = Fixed Administrative Expenses + Variable Administrative Expenses

Or, Total Administrative Expenses = ($26,000 - $2X) + ($2X)

Simplifying: Total Administrative Expenses = $26,000

Adding the total selling expenses and total administrative expenses, we get the total expenses formula:

Total Expenses = Total Selling Expenses + Total Administrative Expenses

Or, Total Expenses = $102,000 + $26,000

Simplifying: Total Expenses = $128,000

Therefore, the cost formula for selling and administrative expenses is:

Y = $128,000 (This is the fixed component)

+ $5X (Variable selling expenses)

+ $2X (Variable administrative expenses)

Or, Y = $78,000 + $7X

Therefore, the best choice is C, Y = $78,000 + $7X.

Variable Selling Expenses:

We are given that variable selling expenses are $5 per book. Therefore, the formula for variable selling expenses is:

Variable Selling Expenses = $5 x Number of Books Sold

Or, Variable Selling Expenses = $5X

Fixed Selling Expenses:

We are also given that the remaining selling expenses are fixed. The income statement tells us that total selling expenses for the quarter were $102,000. Therefore, we can subtract the variable selling expenses from this total to find the fixed selling expenses:

Fixed Selling Expenses = Total Selling Expenses - Variable Selling Expenses

Or, Fixed Selling Expenses = $102,000 - $5X

Total Selling Expenses:

If we add the variable and fixed selling expenses, we get the total selling expenses formula:

Total Selling Expenses = Fixed Selling Expenses + Variable Selling Expenses

Or, Total Selling Expenses = ($102,000 - $5X) + ($5X)

Simplifying: Total Selling Expenses = $102,000

Variable Administrative Expenses:

We are given that variable administrative expenses are 4% of sales. Therefore, the formula for variable administrative expenses is:

Variable Administrative Expenses = 0.04 x Sales

Or, Variable Administrative Expenses = 0.04 x ($50X)

Simplifying: Variable Administrative Expenses = $2X

Fixed Administrative Expenses:

We are also given that the remainder of administrative expenses are fixed. The income statement tells us that total administrative expenses for the quarter were $26,000. Therefore, we can subtract the variable administrative expenses from this total to find the fixed administrative expenses:

Fixed Administrative Expenses = Total Administrative Expenses - Variable Administrative Expenses

Or, Fixed Administrative Expenses = $26,000 - $2X

Total Administrative Expenses:

If we add the variable and fixed administrative expenses, we get the total administrative expenses formula:

Total Administrative Expenses = Fixed Administrative Expenses + Variable Administrative Expenses

Or, Total Administrative Expenses = ($26,000 - $2X) + ($2X)

Simplifying: Total Administrative Expenses = $26,000

Adding the total selling expenses and total administrative expenses, we get the total expenses formula:

Total Expenses = Total Selling Expenses + Total Administrative Expenses

Or, Total Expenses = $102,000 + $26,000

Simplifying: Total Expenses = $128,000

Therefore, the cost formula for selling and administrative expenses is:

Y = $128,000 (This is the fixed component)

+ $5X (Variable selling expenses)

+ $2X (Variable administrative expenses)

Or, Y = $78,000 + $7X

Therefore, the best choice is C, Y = $78,000 + $7X.

Learning Objectives

- Develop equations for cost formulas based on variable and fixed components.