Asked by Emily E Banner on Jun 29, 2024

Verified

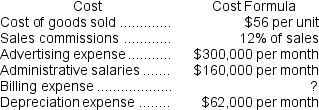

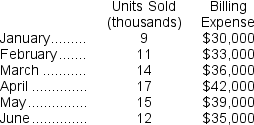

The accounting department of Archer Company, a merchandising company, has prepared the following analysis:  The accounting department feels that billing expense is a mixed cost, containing both fixed and variable cost elements.The billing expenses and sales in units over the last several months follow:

The accounting department feels that billing expense is a mixed cost, containing both fixed and variable cost elements.The billing expenses and sales in units over the last several months follow:  The accounting department now plans to develop a cost formula for billing expense so that a contribution format income statement can be prepared for management's use.

The accounting department now plans to develop a cost formula for billing expense so that a contribution format income statement can be prepared for management's use.

Required:

a.Using the least-squares method, estimate the cost formula for billing expense.Round off both the fixed cost and the variable cost per thousand units sold to the nearest whole dollar.

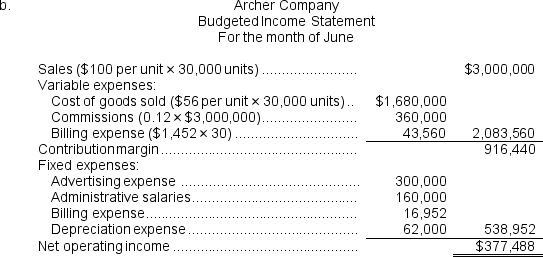

b.Assume that the company plans to sell 30,000 units during July at a selling price of $100 per unit.Prepare a budgeted income statement for the month, using the contribution format.

Mixed Cost

A cost that contains both variable and fixed cost elements, changing in response to changes in production or sales volumes.

Billing Expense

Costs incurred during the billing process, including materials, postage, and labor costs related to preparing and sending out invoices to customers.

Contribution Format

A layout of the income statement that distinguishes between fixed and variable expenses to emphasize the contribution margin.

- Master the least-squares regression methodology and apply it to the study of cost behavior.

- Discriminate between variable costs, fixed costs, and mixed costs.

- Compile a contribution format income statement.

Verified Answer

CH

Corey HillmanJul 01, 2024

Final Answer :

a.Using least-squares regression, the cost formula is

Y = $16,952 + $1,452X, where X is a thousand units.

Y = $16,952 + $1,452X, where X is a thousand units.

Learning Objectives

- Master the least-squares regression methodology and apply it to the study of cost behavior.

- Discriminate between variable costs, fixed costs, and mixed costs.

- Compile a contribution format income statement.