Asked by aditya gauri on May 15, 2024

Verified

Algood Corporation manufactures numerous products, one of which is called Omicron09. The company has provided the following data about this product:

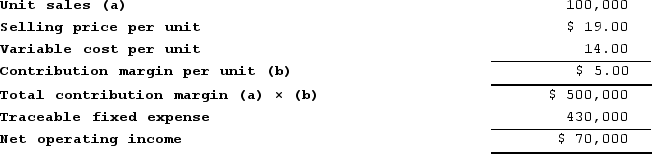

Required:a. What net operating income is the company earning now on its sales of Omicron09?

Required:a. What net operating income is the company earning now on its sales of Omicron09?

b. Management is considering decreasing the price of Omicron09 by 5%, from $19.00 to $18.05. The company's marketing managers estimate that this price reduction would increase unit sales by 15%, from 100,000 units to 115,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will Omicron09 earn at a price of $18.05 if this sales forecast is correct?

c. Assuming that the total traceable fixed expense does not change, how many units of Omicron09 would Algood need to sell at a price of $18.05 to earn the same net operating income that it currently earns at a price of $19.00? (Round your answer up to the nearest whole number.)

Traceable Fixed Expense

Fixed costs that can be directly associated with a specific cost center or business segment.

Net Operating Income

The total profit of a company after subtracting operating expenses but before deducting taxes and interest.

Price Reduction

A decrease in the regular selling price of a product or service, usually to stimulate sales or clear inventory.

- Master the calculation of net operating income and discern its importance in the realm of business decision-making.

- Master the technique for analyzing break-even and profitability considering various scenarios of pricing and expenses.

Verified Answer

b.The profit at the price of $18.05 per unit is computed as follows:Profit = (Selling price per unit − Variable cost per unit) × Quantity sold − Fixed expensesProfit = ($18.05 per unit − $14.00 per unit) × 115,000 units − $430,000Profit = ($4.05 per unit) × 115,000 units − $430,000Profit = $465,750 − $430,000 = $35,750c.Profit = (Selling price per unit − Variable cost per unit) × Quantity sold − Fixed expenses$70,000 = ($18.05 per unit − $14.00 per unit) × Quantity sold − $430,000$500,000 = ($18.05 per unit − $14.00 per unit) × Quantity sold$500,000 = ($4.05 per unit) × Quantity soldQuantity sold = $500,000 ÷ $4.05 per unit = 123,457 units (rounded up)

b.The profit at the price of $18.05 per unit is computed as follows:Profit = (Selling price per unit − Variable cost per unit) × Quantity sold − Fixed expensesProfit = ($18.05 per unit − $14.00 per unit) × 115,000 units − $430,000Profit = ($4.05 per unit) × 115,000 units − $430,000Profit = $465,750 − $430,000 = $35,750c.Profit = (Selling price per unit − Variable cost per unit) × Quantity sold − Fixed expenses$70,000 = ($18.05 per unit − $14.00 per unit) × Quantity sold − $430,000$500,000 = ($18.05 per unit − $14.00 per unit) × Quantity sold$500,000 = ($4.05 per unit) × Quantity soldQuantity sold = $500,000 ÷ $4.05 per unit = 123,457 units (rounded up)

Learning Objectives

- Master the calculation of net operating income and discern its importance in the realm of business decision-making.

- Master the technique for analyzing break-even and profitability considering various scenarios of pricing and expenses.

Related questions

Buzby Corporation Manufactures Numerous Products, One of Which Is Called ...

The Net Operating Income in the Flexible Budget for January ...

Net Operating Income Is Income Before Interest and Taxes

For Performance Evaluation Purposes, the Actual Fixed Costs of a ...

In Service Department Cost Allocations, Sales Dollars Should Be Used ...