Asked by HANNAH MARTE on May 27, 2024

Verified

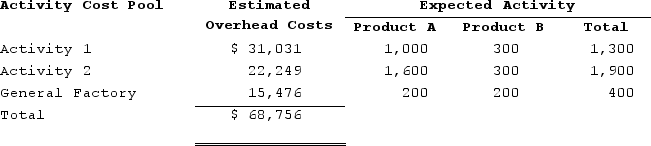

Adelberg Corporation makes two products: Product A and Product B. Annual production and sales are 500 units of Product A and 1,000 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.4 direct labor-hours per unit and Product B requires 0.2 direct labor-hours per unit. The total estimated overhead for next period is $68,756.The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows:  (Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

The predetermined overhead rate (i.e., activity rate) for Activity 2 under the activity-based costing system is closest to:

A) $13.91

B) $11.71

C) $74.16

D) $36.19

Activity-Based Costing

Activity-Based Costing is an accounting method that assigns costs to products or services based on the activities they require.

Predetermined Overhead Rate

An estimated rate used to allocate manufacturing overhead to individual products or job orders based on a specific activity base, such as machine hours.

General Factory

A place where a wide range of items may be manufactured, typically not limited to a specific product line or process.

- Understand and apply the concept of activity-based costing (ABC).

Verified Answer

The estimated overhead cost for Activity 2 is $19,020, and the expected activity for Activity 2 is 1,620 machine-hours. Therefore, the predetermined overhead rate for Activity 2 is:

$19,020 ÷ 1,620 machine-hours = $11.71 per machine-hour

Therefore, the answer is B) $11.71.

Learning Objectives

- Understand and apply the concept of activity-based costing (ABC).

Related questions

Which of the Following Statements Is True Regarding This Company's ...

Figge and Mathews Public Limited Company, a Consulting Firm, Uses ...

Groleau Corporation Has an Activity-Based Costing System with Three Activity ...

The Kamienski Cleaning Brigade Company Provides Housecleaning Services to Its ...

Desjarlais Corporation Uses the Following Activity Rates from Its Activity-Based ...