Asked by Claire Fening on May 26, 2024

Verified

Accrual return on investment versus cash flows

The Flinders Island Airways Pty Ltd is planning a project that is expected to last for six years. During that time, the project is expected to generate net cash inflows of $75 000 per annum.

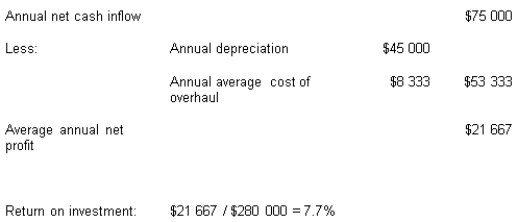

The project will require the purchase of a machine for $280 000. This new machine is expected to have a salvage value of $10 000 at the end of six years. In addition to its annual operating costs, the machine will require an overhaul costing $50 000 at the end of the fourth year. The company presently has a minimum desired rate of return of 12 per cent. Based on this information, the accountant prepared the following analysis:

Therefore, the accountant recommends that the project be rejected, as it does not meet the company's minimum desired rate of return.

i. What criticism(s) would you make of the accountant's evaluation of the project?

Salvage Value

The estimated value that an asset will realize upon its sale at the end of its useful life.

Accrual Return

The return on investment that is recognized in financial statements before any cash changes hands.

Net Cash Inflows

The amount of cash received by a company from its various operational, investment, and financing activities, minus cash outflows, during a specific period.

- Understand the distinctions and uses of discounted cash flow (DCF) analysis compared to accrual accounting in the assessment of capital investments.

- Learn about the complexities involved in predicting future cash flows and capital budgeting adjustments for risk.

Verified Answer

iii. Is the internal rate of return greater or less than 12 per cent?

i. The accountant is using the accrual accounting rate of return, which ignores the time value of money.

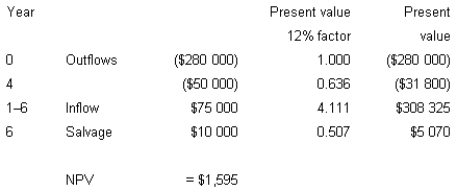

ii.

The project should be accepted. There is a positive net present value and therefore the rate of return is higher than the desired rate.

The project should be accepted. There is a positive net present value and therefore the rate of return is higher than the desired rate.iii. Since the net present value of the project is positive using a discount rate of 12 per cent, the internal rate of return is greater than 12 per cent.

Learning Objectives

- Understand the distinctions and uses of discounted cash flow (DCF) analysis compared to accrual accounting in the assessment of capital investments.

- Learn about the complexities involved in predicting future cash flows and capital budgeting adjustments for risk.

Related questions

Estimate the Internal Rate of Return (IRR) ...

Conflict Between Discounted Cash Flow (DCF) Analysis and Accrual Accounting ...

Which One of the Following Most Likely Represents the Greatest ...

Consider the Following Statement by a Project Analyst: I Analyzed ...

A Firm Is Considering a New Project Whose Risk Is ...