Asked by Emily Perez on Apr 27, 2024

Verified

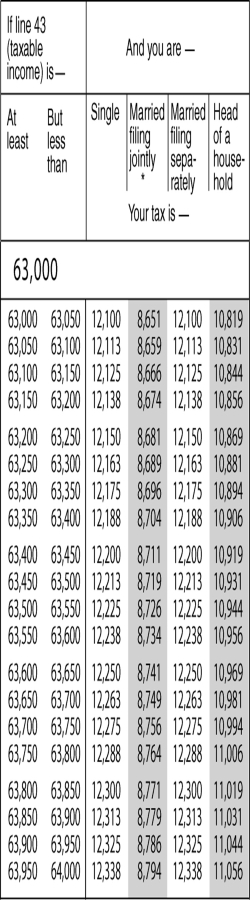

A single mother who files head of household pays a tax of $10,881.Use the table to find her taxable income interval.

Taxable Income Interval

A range of income subject to taxation, often determined by tax brackets.

Single Mother

A woman who has a child or children and is raising them without the support of their other parent.

Head of Household

A tax filing status for unmarried individuals who provide the main source of support for one or more qualifying persons in their home.

- Employ tax rates and schedules to ascertain taxable income and figure out taxes owed for both individuals and married couples filing jointly.

Verified Answer

EL

Learning Objectives

- Employ tax rates and schedules to ascertain taxable income and figure out taxes owed for both individuals and married couples filing jointly.