Asked by Misti Graham on Apr 24, 2024

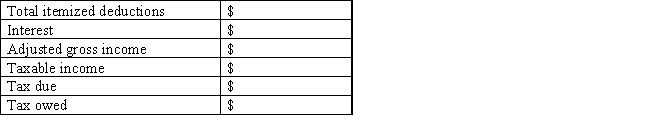

Abraham is a single taxpayer with no dependents.He received $297 in bank interest and $1,500 for an educational expenses deduction.His charitable contributions were $2,000.

Use the information to complete the table below: Wages,tips,and other compensation: $47,513;Social Security withheld based on wages of $47,513;Medicare withheld based on wages of $47,513;federal tax withheld: $4,325;state tax withheld: $2,790.Assume $3,500 per exemption and use the tax rate for the income interval for $32,550 to $78,850 of $4,481.25 + 25% for taxable income over $32,550.

Educational Expenses Deduction

A tax deduction allowing taxpayers to deduct certain expenses for education from their taxable income, enhancing affordability of education.

Charitable Contributions

Financial donations made to non-profit organizations, which can often be tax-deductible.

Tax Rate

The percentage at which an individual or corporation is taxed.

- Recognize and compute deductions, credits, and exemptions and their impact on taxable income and tax liability.

- Use tax rates and schedules to estimate taxable income and evaluate taxes required for individuals and married couples filing jointly.

Learning Objectives

- Recognize and compute deductions, credits, and exemptions and their impact on taxable income and tax liability.

- Use tax rates and schedules to estimate taxable income and evaluate taxes required for individuals and married couples filing jointly.