Asked by Francine Fiscor on May 09, 2024

Verified

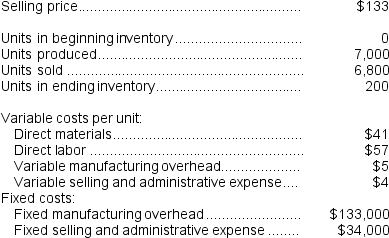

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:  What is the total period cost for the month under absorption costing?

What is the total period cost for the month under absorption costing?

A) $61,200

B) $133,000

C) $34,000

D) $194,200

Absorption Costing

A costing method that includes all manufacturing costs - direct materials, direct labor, and both variable and fixed overhead - in the cost of a product.

Total Period Cost

The sum of all costs incurred during a specific financial period, encompassing both manufacturing and non-manufacturing expenses.

- Analyze the effects of inventory changes on net operating income under variable and absorption costing.

Verified Answer

BG

Bella GutkinMay 16, 2024

Final Answer :

A

Explanation :

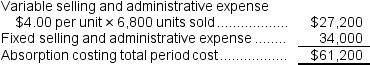

To calculate the total period cost under absorption costing, we need to add up all the fixed manufacturing overhead costs that have been incurred in the period. From the data provided, we can see that the following fixed overhead costs have been incurred:

- Supervisory salaries: $22,000

- Rent on facilities: $16,000

- Depreciation on equipment: $10,000

- Property taxes on facilities and equipment: $13,200

Adding these costs together gives us a total of $61,200, which is the period cost under absorption costing. Therefore, the correct answer is A.

- Supervisory salaries: $22,000

- Rent on facilities: $16,000

- Depreciation on equipment: $10,000

- Property taxes on facilities and equipment: $13,200

Adding these costs together gives us a total of $61,200, which is the period cost under absorption costing. Therefore, the correct answer is A.

Explanation :

Learning Objectives

- Analyze the effects of inventory changes on net operating income under variable and absorption costing.