Asked by Adarsh Prasad on May 25, 2024

Verified

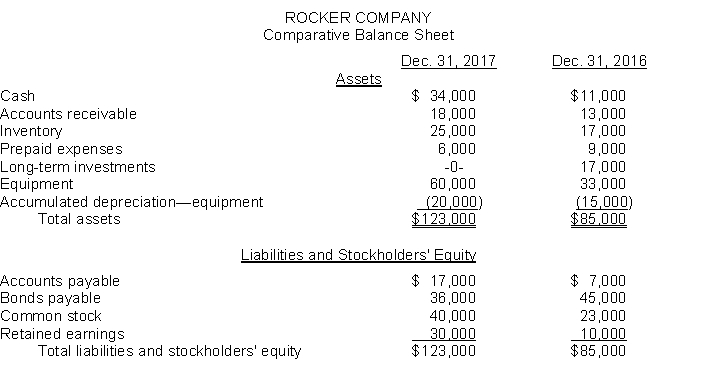

A comparative balance sheet for Rocker Company appears below:  Additional information:

Additional information:

1. Net income for the year ending December 31 2017 was $35000.

2. Cash dividends of $15000 were declared and paid during the year.

3. Long-term investments that had a cost of $17000 were sold for $14000.

4. Sales for 2017 were $120000.

Instructions

Prepare a statement of cash flows for the year ended December 31 2017 using the indirect method.

Indirect Method

A cash flow statement format that starts with net income and adjusts for non-cash transactions and changes in working capital to arrive at net cash provided by operating activities.

Comparative Balance Sheet

A financial statement that compares the balance sheets of two periods, highlighting changes in assets, liabilities, and equity.

Net Income

The total profit of a company after subtracting all its expenses from its revenues.

- Execute the direct and indirect procedures to determine the net cash yielded by operating activities.

- Investigate the implications of balance sheet account shifts on cash flow dynamics.

- Organize the activity section of the cash flow statement utilizing the indirect method.

Verified Answer

Learning Objectives

- Execute the direct and indirect procedures to determine the net cash yielded by operating activities.

- Investigate the implications of balance sheet account shifts on cash flow dynamics.

- Organize the activity section of the cash flow statement utilizing the indirect method.

Related questions

In Converting Net Income to Net Cash Provided by Operating ...

Garton Company Had Net Income of $195000 in 2016 ...

Plexis Company Reported Net Income of $148000 ...

A Comparative Balance Sheet for Halpern Corporation Is Presented Below ...

Show Company Had Total Operating Expenses of $153000 in 2016 ...