Asked by Rebekah Turner on Jul 09, 2024

Verified

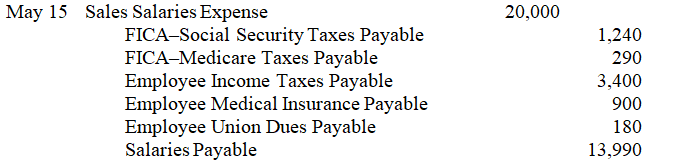

A company's payroll for the week ended May 15 included earned salaries of $20,000.All of that week's pay is subject to FICA social security taxes of 6.2% and Medicare taxes of 1.45%.In addition,the company withholds the following amounts for this weekly pay period: $900 for medical insurance,$3,400 for federal income taxes,and $180 for union dues.

a.Prepare the general journal entry to accrue the payroll.

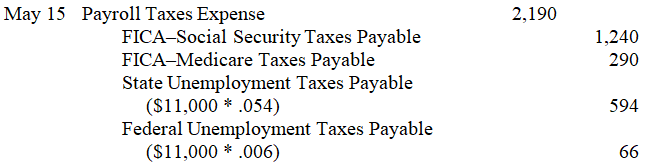

b.The company is subject to state unemployment taxes at the rate of 5.4% and federal unemployment taxes at the rate of 0.6%.By May 15,some employees had earned over $7,000,so only $11,000 of the $20,000 weekly gross pay was subject to unemployment tax.Prepare the general journal entry to accrue the employer's payroll tax expense.

FICA Taxes

Federal Insurance Contributions Act taxes are payroll taxes deducted from employees' paychecks and matched by employers to fund Social Security and Medicare.

Medicare Taxes

Taxes collected in the United States to fund the Medicare program, typically withheld from employee earnings.

Union Dues

Fees paid by workers to labor unions for membership and benefits.

- Understand the process of calculating and recording payroll and related taxes, including federal and state unemployment taxes, FICA taxes, and withholdings.

- Develop the ability to prepare general journal entries for payroll transactions, including accruals and payments.

Verified Answer

CN

Learning Objectives

- Understand the process of calculating and recording payroll and related taxes, including federal and state unemployment taxes, FICA taxes, and withholdings.

- Develop the ability to prepare general journal entries for payroll transactions, including accruals and payments.