Asked by Viralou Zafico on Jun 13, 2024

Verified

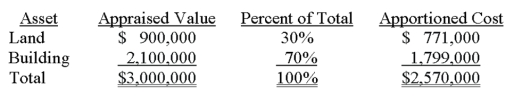

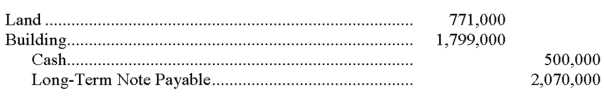

A company purchased land with a building for a total cost of $2,570,000 ($500,000 paid in cash and the balance on a long-term note). It was estimated that the land and building had market values of $900,000 and $2,100,000, respectively.

Determine the cost to be apportioned to the land and to the building and prepare the journal entry to record the acquisition.

Market Values

The current price at which an asset or service can be bought or sold in the marketplace.

- Develop an understanding and implement practices related to accounting principles for the management of asset acquisition and disposal, notably in determining costs and preparing journal entries.

- Estimate and record the investment in acquiring premises, such as lands, edifices, and industrial equipment.

Verified Answer

CS

Learning Objectives

- Develop an understanding and implement practices related to accounting principles for the management of asset acquisition and disposal, notably in determining costs and preparing journal entries.

- Estimate and record the investment in acquiring premises, such as lands, edifices, and industrial equipment.

Related questions

Randal's Rifles Purchased Some Equipment by Issuing a Three-Year 6 ...

On April 1, 2010, Richer Corporation Purchased a New Machine ...

Which One of the Following Types of Costs Should Not ...

The Roth Company Incurred the Following Costs in the Acquisition ...

The Debit for a Sales Tax Paid on the Purchase ...