Asked by Eveleen Zapata on May 02, 2024

Verified

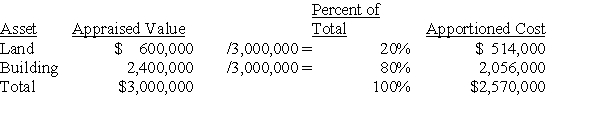

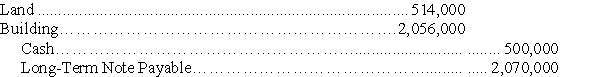

A company purchased land with a building for a lump-sum cost of $2,570,000 ($500,000 paid in cash and the balance on a long-term note).It was estimated that the land and building had market values of $600,000 and $2,400,000,respectively.

Determine the cost to be apportioned to the land and to the building and prepare the journal entry to record the acquisition.

Lump-Sum Cost

A single total amount charged or paid for a group of services, rights, or products, rather than charging for them separately.

Market Values

The current value of an asset or company based on the prices at which its securities are traded in the market.

Journal Entry

The recording of financial transactions into accounting records, or journals, indicating accounts affected, amounts, and the date.

- Identify the distinctions in accounting procedures for capital expenditures versus revenue expenditures.

Verified Answer

ZK

Learning Objectives

- Identify the distinctions in accounting procedures for capital expenditures versus revenue expenditures.