Asked by Sumayyah Bachooa on Jul 17, 2024

Verified

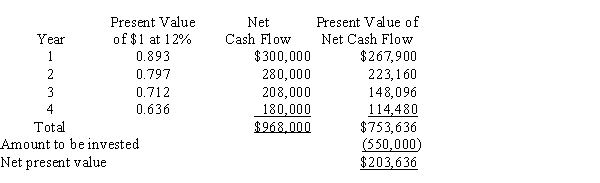

A $550,000 capital investment proposal has an estimated life of 4 years and no residual value. The estimated net cash flows are as follows:  The minimum desired rate of return for net present value analysis is 12%. The factors for the present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years are 0.893, 0.797, 0.712, and 0.636, respectively.

The minimum desired rate of return for net present value analysis is 12%. The factors for the present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years are 0.893, 0.797, 0.712, and 0.636, respectively.

Determine the net present value.

Present Value

Today's worth of money or cash flows that are expected to be received in the future, considering a certain rate of profitability.

Compound Interest

The process of calculating interest not only on the principal amount but also on accumulated interest from earlier time frames of a deposit or loan.

Capital Investment

Funds spent by a firm to acquire or upgrade physical assets such as property, industrial buildings, or equipment.

- Perceive the concept and essentiality of Net Present Value (NPV) in the analysis of capital investments.

- Master the technique to compute the Net Present Value of diverse investment proposals leveraging present value factors.

Verified Answer

KD

Learning Objectives

- Perceive the concept and essentiality of Net Present Value (NPV) in the analysis of capital investments.

- Master the technique to compute the Net Present Value of diverse investment proposals leveraging present value factors.