Asked by Jamie Cunningham on Mar 10, 2024

Verified

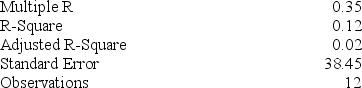

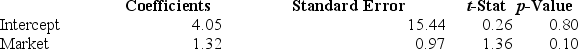

You run a regression for a stock's return on a market index and find the following Excel output:

This stock has greater systematic risk than a stock with a beta of ________.

A) .50

B) 1.5

C) 2

D) 3

Systematic Risk

Systematic risk refers to the risk inherent to the entire market or market segment, often influenced by factors like economic, political, and social changes.

Beta

A measure of the volatility or systematic risk of a security or a portfolio compared to the market as a whole.

- Examine regression findings relevant to stock and market returns.

Verified Answer

A

Answered By Askgram User

Mar 10, 2024Final Answer :

A

Explanation :

Explanation: .50 < 1.32

Explanation :

.50 < 1.32

Learning Objectives

- Examine regression findings relevant to stock and market returns.